About HD Vital Guard – Retired

Many costs associated with an accident are not covered by major medical plans, such as lost income due to time off the job, transportation to and from medical care visits and help with child care, meals and other household duties. Supplemental insurance through a HD Vital Guard membership plan can help by providing cash benefits to use however you choose – for out-of-pocket medical expenses, transportation costs, or even to pay routine monthly bills.

Click Each Tab Below to Learn More About HD Vital Guard – Retired - Open All Tabs

Association Benefits

Health Care Discounts

Hearing Products and Screenings

Hearing Products and Screenings

Members and their immediate family members (grandparents, parents, spouse and children) will receive complimentary hearing screenings and a 15% retail discount off the usual and customary retail price of any Beltone hearing instrument at any of over 1500 locations throughout the United States.

Dental

Dental

Members and their dependents can save 15% to 50%* on dental care through our Dental network of over 110,000 participating provider listings, including both general dentists and specialists across America.

Simply select a participating dentist in your area and present your membership card at your appointment to receive the discounted rates. There is no limit to the number of visits and you can change dentists within the network at any time for any reason.

IDLife Nutritional Products

IDLife Nutritional Products

IDLife products are scientifically formulated to help you by providing therapeutic doses of specific nutrients to:

- Restore nutrients depleted by your Rx program

- Help your body resist Rx side effects

- Improve your overall nutrition status thus optimizing your health

Additionally, they have been pre-screened to avoid drug/nutrient interactions that may be present with your current vitamin program.

Laboratory Testing

Laboratory Testing

MyMedLab offers an efficient, affordable and confidential solution to medical laboratory testing. You can purchase the same testing ordered by your doctor at a cost 50% to 80% less than in your doctor’s office or local hospital lab.

Testing can be purchased 24 hours a day on the MyMedLab website. Tests are listed both individually and in groups called Wellness Profiles based on your age, sex and family history. This basic information is all you need to identify which profile evaluates your risk for common conditions associated with your specific group.

Diagnostic Testing

Diagnostic Testing

Radiology tests have become key tools for physicians to help diagnose and monitor disease. Through One Call Care, our members can save 20% to 50% on MRIs, PET and CT scans when these tests are ordered by a doctor. Make the most out of your health plan and take advantage of optimal quality, convenience, and savings with just one call.

ScriptSave Rx Savings Card

ScriptSave Rx Savings Card

The ScriptSave Prescription Savings Card provides you access to discounted prescription drug prices. All household members can use the same card – including pets, if the pet medication is a common drug that is also used by people. There are no limits on how many times members and their family can use the card.

Value Added Benefits

MES Vision

Through the MES Vision program, our members receive one vision examination every 12 months plus 20% discounts on a variety of eyewear products.

Karis360

Karis360’s team of Advisors offer personalized, caring, expert service helping members navigate the complex and expensive healthcare maze. With services from Healthcare Navigator to Bill Negotiator to Surgery Saver to Chaplaincy, Karis360 will sort through your healthcare needs saving you time and money.

Karis360 sorts through healthcare paperwork

Karis360 saves time and money

Karis360 provides unlimited assistance from a Personal Advisor

View real member testimonials for:

Bill Negotiation Health Care Navigator

Insured Benefits

Group Accident Insurance Plans

Underwritten by Catlin Insurance Company, Inc

| Benefit Description | |

| Hospital Cash1 | |

| Benefit Amount per Day | $500 |

| Maximum Benefit Period per Hospital Stay per Covered Accident | 30 days |

| Accident Disability Income2 (Not Available in CA) | |

| Maximum Benefit per Covered Accident per Covered Person | 50% of salary, up to $500 per week |

| Maximum Benefit Period | 26 weeks |

| Elimination Period before eligible for benefits | 60 days |

| In-Hospital Accident Medical Expense Insurance1 (Excludes Pre-Existing Conditions as defined in the Certificate) | |

| In-Hospital Accident Medical Expense Limit per Covered Accident per Covered Person | $3,300 |

| Accident Medical Expense Insurance1 (Excludes Pre-Existing Conditions as defined in the Certificate) | |

| Accident Medical Expense Limit per Covered Accident per Covered Person | $3,300 |

| Deductible per Covered Accident | $250 |

| Air Ambulance1 | |

| Maximum Benefit per Covered Accident per Covered Person | $10,000 |

| Critical Illness Insurance3 (Excludes Pre-Existing Conditions as defined in the Certificate) | |

| Maximum Benefit Amount | $6,600 |

| Covered Critical Illnesses are: Invasive Cancer; Heart Attack (Myocardial Infarction); Coronary Artery Bypass Graft; Kidney (Renal) Failure; Major Organ Transplant; Paralysis; Stroke; Coma. | 100% |

| Accidental Death & Dismemberment Insurance4 | |

| Principal Sum - Member, Spouse, Child(ren) | $100,000 |

| Schedule of Covered Losses | |

| Covered Loss | Benefit |

| Life | 100% |

| Two or More Hands or Feet | |

| Sight of Both Eyes | |

| Speech and Hearing (in both ears) | |

| One Hand or Foot | 50% |

| Sight in One Eye | |

| Severance and Reattachment of One Hand or Foot | |

| Speech | |

| Hearing (in both ears) | |

| Thumb and Index Finger of the Same Hand | 25% |

| All Four Fingers of the Same Hand | |

| All the Toes of the Same Foot | 20% |

Disclaimers

Monthly Rates

| HD Vital Guard Monthly Membership Rates | |

|---|---|

| Member | $107 |

| Member + 1 | $153 |

| Member + Family | $215 |

FAQ / About the Carrier

About the Carrier

XL Catlin

XL Catlin, through the insurance subsidiaries of XL Group plc, is a global insurance and reinsurance company providing property, casualty and specialty products to industrial, commercial and professional firms, insurance companies and other enterprises on a worldwide basis. With enhanced product development capability, XL Catlin can offer larger policies on larger risks and writes more than 30 lines of business. Our underwriters work in parallel with clients and their brokers to develop imaginative and effective risk management solutions. XL Catlin brings an incredible blend of people, products, services and technology to help businesses and people move forward. From insurance to reinsurance, XL Catlin can help you find innovative answers for a changing world. XL Catlin is the global brand used by XL Group plc’s insurance companies, including Catlin Insurance Company, Inc.

Financial Ratings

XL Group plc’s core operating subsidiaries receive consistently high ratings for financial strength from A.M. Best and Standard & Poor’s, the leading independent analysts for the insurance industry.

Membership Eligibility

• Between the ages of eighteen (18) and sixty-four (64)

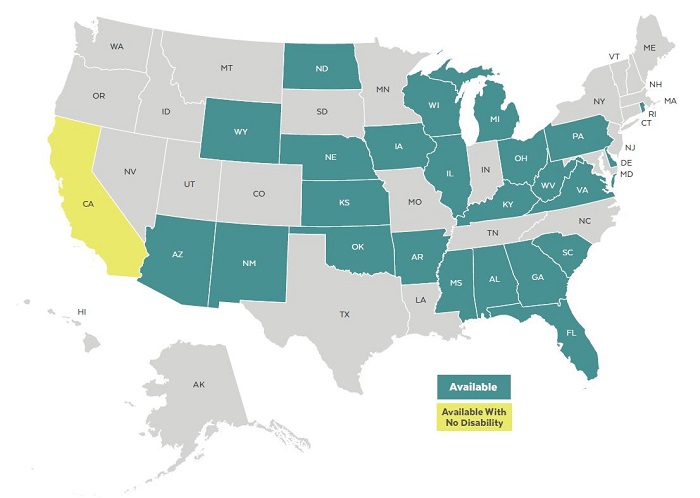

• Reside in an available state

• Not enrolled in Medicare, Medicaid, Medical Disability or any other Federal or state-funded program

• Dependent children must be under age nineteen (19); twenty-four (24) if a Full-Time Student

Accident Disability Income is not available in California. Members residing in CA will not have access to the Disability benefit.

This insurance is not available to any resident of the State of Utah.

Health Care Discounts Disclosure

Not Available in AK, OK, UT, VT, WA. If members move to one of those states, their discount medical benefits will terminate.

The discount medical, health and drug benefits (The Plan) are NOT insurance, a health insurance policy, a Medicare Prescription Drug Plan or a qualified health plan under the Affordable Care Act.

The Plan provides discounts for certain medical services, pharmaceutical supplies, prescription drugs or medical equipment and supplies offered by providers who have agreed to participate in the Plan. The range of discounts for medical, pharmacy or ancillary services offered under The Plan will vary depending on the type of provider and products or services received. The Plan does not make and is prohibited from making members’ payments to providers for products or services received under The Plan. The Plan member is required and obligated to pay for all discounted prescription drugs, medical and pharmaceutical supplies, services and equipment received under The Plan, but will receive a discount on certain identified medical, pharmaceutical supplies, prescription drugs, medical equipment and supplies from providers in The Plan. The Discount Medical Plan Organization/Discount Plan Organization is Alliance HealthCard of Florida, Inc., 5005 LBJ Freeway, Suite 1500, Dallas, Texas 75244. You may call 214-436-8882 or email customerservice@premierhsllc.com for more information or visit myhealthaccountmanager.com for a list of providers. The Plan will make available before purchase and upon request, a list of program providers and the providers’ city, state and specialty, located in the member’s service area. Alliance HealthCard of Florida, Inc. does not guarantee the quality of the services or products offered by individual providers. You have the right to cancel your membership at any time. If you cancel your membership within 30 days of the effective date, you will receive a full refund of all periodic charges. The processing fee is non-refundable except in AR, MD and TN. To cancel you must, notify the Health Depot Association verbally or in writing; notify Health Depot Association at 2601 Network Blvd, Suite 500, Frisco, TX 75034 or by calling 214-436-8882. We will stop collecting membership fees in a reasonable amount of time, but no later than 30 days after cancellation. Any complaints should be directed to Alliance HealthCard of Florida, Inc. at the address or phone number above. Upon receipt of the complaint, member will receive confirmation of receipt within 5 business days. After investigation of the complaint, Alliance HealthCard of Florida, Inc. will provide member with the results and a proposed resolution no later than 30 days after receipt of the complaint.

Note to DE, IL, LA, NE, NH, OH, RI, SD, TX, and WV consumers: If you remain dissatisfied after completing the complaint system, you may contact your state department of insurance.

Note to MA consumers: The plan is not insurance coverage and does not meet the minimum creditable coverage requirements under M.G.L. c. 111M and 956 CMR 5.00.