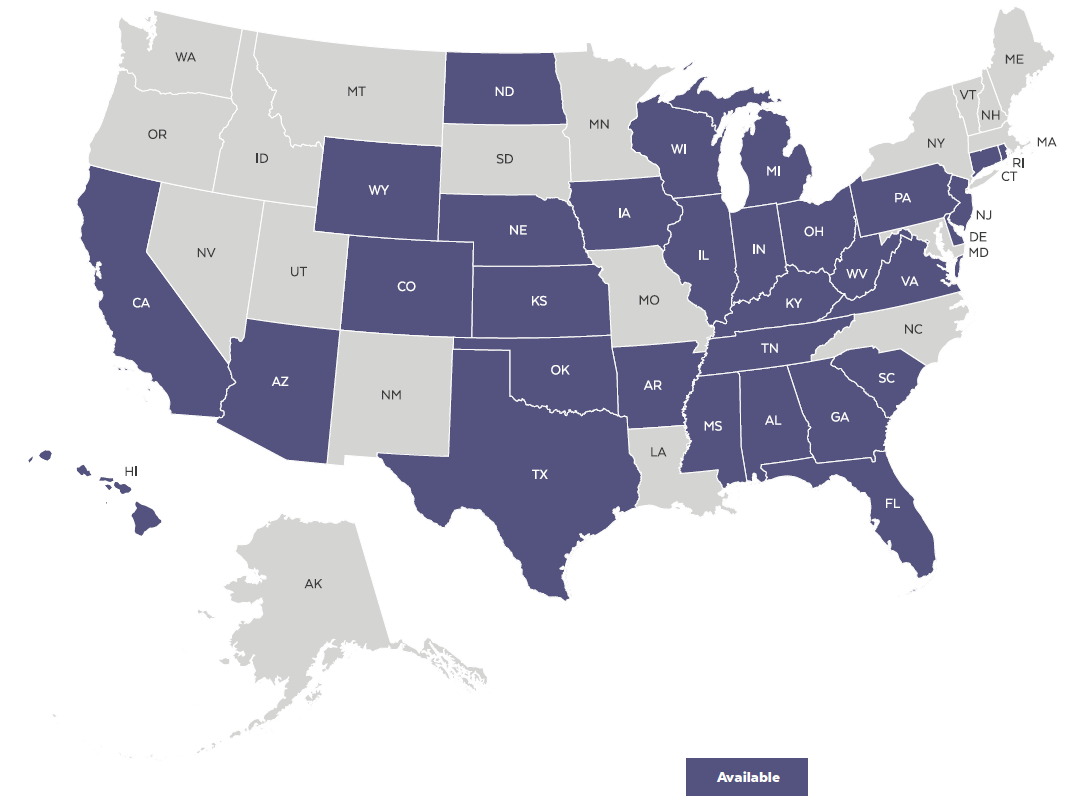

About HD BasicProtect

![]() HD BasicProtect gives members access to valuable resources especially designed to assist during a time of loss. In addition to the non-insurance benefits* provided by The Health Depot Association, a BasicProtect membership also provides members with access to Group Term Life Insurance benefits underwritten by Guarantee Trust Life Insurance Company.

HD BasicProtect gives members access to valuable resources especially designed to assist during a time of loss. In addition to the non-insurance benefits* provided by The Health Depot Association, a BasicProtect membership also provides members with access to Group Term Life Insurance benefits underwritten by Guarantee Trust Life Insurance Company.

No one can predict what the future will bring. That’s why having a safety net like life insurance can bring peace of mind for you and your loved ones. Life insurance can help protect those who depend on you after you are gone by providing financial resources for daily living expenses such as bills, debts and other needs, as well as future expenses like college.

As you review your estate’s liability, including taxes, legal costs and administrative fees, life insurance can be used as a planning tool to cover these areas. It is critical to cover both the primary breadwinner for the family, as well as those who are non-working or stay-at-home parents. Life insurance helps to maintain your household expenses and possibly avoid outsourcing child care after a loss.

Feel confident about protecting your family’s financial plan. Life insurance helps to provide you and your loved ones with a secure financial future.

*Association non-insured benefits vary by level. Consult member guide for more details.

Health Depot Association (HD) and Guarantee Trust Life Insurance Company (GTL) are separate legal entities and have sole financial responsibility for their own products.