About HD SecureShield

![]() HD SecureShield gives members access to valuable resources, especially designed to assist when unexpected emergencies arise. In addition to the non-insured benefits* provided by The Health Depot Association, a SecureShield membership also provides members with access to supplemental Group Accident Only Insurance benefits, underwritten by Guarantee Trust Life Insurance Company.

HD SecureShield gives members access to valuable resources, especially designed to assist when unexpected emergencies arise. In addition to the non-insured benefits* provided by The Health Depot Association, a SecureShield membership also provides members with access to supplemental Group Accident Only Insurance benefits, underwritten by Guarantee Trust Life Insurance Company.

Having supplemental insurance can help in the event of an accident or critical illness. Best of all, members can use the cash benefits however they choose – for out-of-pocket medical expenses, transportation costs, help with child care, meals or other household duties or even to pay routine monthly bills.

*Association non-insured benefits vary by level. Consult member guide for more details.

Health Depot Association (HD) and Guarantee Trust Life Insurance Company (GTL) are separate legal entities and have sole financial responsibility for their own products.

Click Each Tab Below to Learn More About HD SecureShield - Open All Tabs

Association Benefits

Consumer Discounts

Financial Counseling

Financial Counseling

Through My Secure Advantage (MSA), HD members and eligible family members have all the resources needed to feel confident about financial goals in any stage of life – be it growing a family, buying a house, caring for aging parents, or planning retirement.

CLC ID Theft & Fraud Resolution

CLC ID Theft & Fraud Resolution

Members and family receive identity theft and fraud resolution services through CLC, Inc. The CLC identity theft resolution program was developed to help guide victims of identity theft and other fraudulent crimes through the complex process of restoring their personal identity, credit rating, financial security, and legal integrity. This benefit includes ID Monitoring, Fraud Restoration, Document Preparation, Lost/Stolen Purse or Wallet Services, Financial Coaching, and Legal Consultation.

CLC Legal Access

CLC Legal Access

Through the CLC Legal Access program, our members have access to free initial legal consultations and discounted services to address many common legal concerns. Members also receive simple will preparation and access to online legal resources at no additional cost.

Tax Preparation

Tax Preparation

Experience the freedom of stress-free tax filing. Enjoy the ease and convenience of filing your federal return for free, regardless of your tax situation. With direct e-filing to the IRS, your submission is fast, efficient, and hassle-free. Plus, rest assured knowing that all tax situations are covered, whether simple or complex. For added convenience, take advantage of the state filing option for just $14.99. As an IRS-approved e-file provider, FreeTaxUSA ensures the safety and security of your sensitive information.

Travel Savings

Travel Savings

Personal service and best prices on travel! Member pricing is GUARANTEED to be lower than those “public” websites. TravCredits™ are designed to reduce the price of hotels, resorts, and condominiums. TravNow™ reveals the retail rate of a specific property, then allows members to use their TravCredits™ to “buy down” the retail website rate. Whether planning a business trip, family vacation, or road trip with that someone special, TravNow™ has literally hundreds of thousands of hotels to choose from, worldwide.

Estate Planning Tool

Estate Planning Tool

Creating a will is simple and intuitive using an easy tool with questions about the member and their wishes. Members receive a PDF document that is theirs to download and print with instructions on how to make it official. And once an account is created, members can update and/or edit their will, or generate a new one at any time. FreeWill also includes tools to create an Advance Healthcare Directive, as well as a Durable Financial Power of Attorney.

Health Care Discounts

Emergency Medical Air Transport

Emergency Medical Air Transport

At home or abroad, the entire suite of AirMed medical transport benefits is available to Health Depot members on select membership levels without deductibles, claim forms or out-of-pocket expenses.

If a medical emergency occurs while you are hours from home or halfway around the globe, members have seamless access to the highest level of acute care provided by the leading air medical company in North America – AirMed.

IDLife Nutritional Products

IDLife Nutritional Products

IDLife products are scientifically formulated to help you by providing therapeutic doses of specific nutrients to:

- Restore nutrients depleted by your Rx program

- Help your body resist Rx side effects

- Improve your overall nutrition status thus optimizing your health

Additionally, they have been pre-screened to avoid drug/nutrient interactions that may be present with your current vitamin program.

Wellness Resource

Wellness Resource

A multifaceted health and wellness resource providing members with extensive nutrition, fitness, stress management, sleep wellness, and supplementation information. Members have access to wellness articles, fitness video archive, personalized healthy meal guide generator, relaxing sleep wellness sounds, 20+ high value wellness brand discounts, wellness assessments, an alternative medicine practitioner finder, and more.

Insurance Benefits

Guarantee Trust Life Insurance Company

| GROUP ACCIDENT ONLY INSURANCE PLANSUnderwritten by Guarantee Trust Life Insurance Company (GTL)Policy Form MP-1400 (or MP-1300) issued to Health Depot Association | ||||

| Benefit Description | Level 1 | Level 2 | Level 3 | Level 4 |

| Accident Medical Expense Benefit (AME)1 | ||||

| Maximum Amount per Covered Accident | $2,500 | $5,000 | $7,500 | $10,000 |

| Deductible per Covered Accident per Insured | $250 | $250 | $250 | $250 |

| Initial Treatment Period | 60 Days | 60 Days | 60 Days | 60 Days |

| Benefit Period | 12 Months | 12 Months | 12 Months | 12 Months |

| Covered Charges | ||||

| Hospital room and board, and general nursing care, up to the semi-private room rate | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Hospital miscellaneous expense during Hospital Confinement or for outpatient surgery under general anesthetic, such as the cost of the operating room, laboratory tests, x-ray examinations, anesthesia, drugs (excluding take-home drugs) or medicines, therapeutic services and supplies | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Doctor's fees for surgery | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Anesthesia services | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Doctor's visits, inpatient and outpatient, each visit | $75 | $75 | $75 | $75 |

| Hospital Emergency care | $500 | $500 | $500 | $500 |

| X-ray and other diagnostic tests | $250 | $250 | $250 | $250 |

| Ambulance expense | $250 | $250 | $250 | $250 |

| Durable Medical Equipment | $100 | $100 | $100 | $100 |

| Prescription Drugs | $500 | $500 | $500 | $500 |

| Dental treatment for Injury to Sound Natural Teeth | $250 per tooth up to a maximum of $500 | $250 per tooth up to a maximum of $500 | $250 per tooth up to a maximum of $500 | $250 per tooth up to a maximum of $500 |

| Physical Therapy | $60 for first visit; $30 for each visit thereafter | $60 for first visit; $30 for each visit thereafter | $60 for first visit; $30 for each visit thereafter | $60 for first visit; $30 for each visit thereafter |

| Registered Nurse expense | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Accidental Death & Dismemberment Benefit (AD&D)2 | ||||

| Principal Sum - Member, Spouse, Child(ren) | $2,500 | $5,000 | $7,500 | $10,000 |

| Schedule of Benefits | ||||

| Loss of Life | 100% | 100% | 100% | 100% |

| Loss of Both Hands | ||||

| Loss of Both Feet | ||||

| Loss of the Entire Sight of Both Eyes | ||||

| Loss of One Hand and One Foot | ||||

| Loss of Speech and Hearing | ||||

| Loss of One Hand or One Foot and Entire Sight of One Eye | ||||

| Loss of One Hand or One Foot | 50% | 50% | 50% | 50% |

| Loss of Entire Sight of One Eye | ||||

| Loss of Speech or Hearing | ||||

| Loss of Hearing in One Ear | 25% | 25% | 25% | 25% |

1 Accident Medical Expense Benefit does not pay for reinjury or complications of an injury caused or contributed to by a condition that existed before the Accident.

This benefit pays in excess of any other insurance coverage you may have for the expenses you are charged by a hospital, doctor, or certain other charges, up to a maximum of the amount listed if you are injured in a Covered Accident. GTL will pay based on the Reasonable and Customary charges for Medically Necessary treatment of a Covered Injury incurred by the Covered Person resulting from a Covered Accident, after the $250.00 Deductible is satisfied. The first treatment or service must occur within 60 days of the Covered Accident and all subsequent treatments must be incurred within 12 Months of the Covered Accident. Benefits will be paid up to the amount stated in the Schedule of Benefits.

2 Accidental Death and Dismemberment Benefits are provided as shown in the Schedule of Benefits and pays the member or beneficiary up to the benefit amount listed for the member’s death or dismemberment due to a Covered Accident.

The Accidental Death & Dismemberment benefit pays the amount shown if you suffer a Covered Loss resulting from a Covered Accident. If you sustain more than one Covered Loss as a result of the same Covered Accident, only the largest available benefit will be paid. If the loss results in death, benefits will only be paid under the Loss of Life benefit provision.

Percentages relate to the Principal Sum benefit as shown above for the Primary, Spouse and Child(ren).

Guarantee Trust Life Insurance Company

| GROUP ACCIDENT ONLY INSURANCE PLANSUnderwritten by Guarantee Trust Life Insurance Company (GTL)Policy Form Series MP-1400 and Rider Form Series GRG15CR and GRG15HAS issued to Health Depot Association | ||||

| Benefit Description | Level 1 | Level 2 | Level 3 | Level 4 |

| Critical Illness Benefit (CI)* | ||||

| Benefit Eligibility | ||||

| Waiting Period | 60 Days | 60 Days | 60 Days | 60 Days |

| Pre-Existing Conditions Period | 12 Months | 12 Months | 12 Months | 12 Months |

| Benefit Eligibility for Pre-Existing Conditions | 12 Months After Effective Date | |||

| Limited Specified Disease Benefit Rider | $2,500 | $5,000 | $7,500 | $10,000 |

| Heart Attack | 100% | 100% | 100% | 100% |

| Stroke | ||||

| Cancer Lump Sum Benefit Rider | $2,500 | $5,000 | $7,500 | $10,000 |

| Cancer Lump Sum Benefit | 100% | 100% | 100% | 100% |

*Pays a Lump Sum Benefit Amount as shown in the Schedule upon the first diagnosis of a Covered Condition.

Benefits under these riders terminate on the earliest date that the member turns age 65 or the date we have paid all benefits.

Guarantee Trust Life Insurance Company

| GROUP ACCIDENT ONLY INSURANCE PLANS Underwritten by Guarantee Trust Life Insurance Company Policy Form Series MP-1400 issued to Health Depot Association |

||||

| Benefit Description | Level 1 | Level 2 | Level 3 | Level 4 |

| Accidental Death & Dismemberment Benefit (AD&D)3 | ||||

| Principal Sum | $50,000 | $100,000 | $200,000 | $300,000 |

| Primary | 100% | 100% | 100% | 100% |

| Spouse | 50% | 50% | 50% | 50% |

| Child(ren) | 25% | 25% | 25% | 25% |

| Schedule of Benefits | ||||

| Loss of Life | 100% | 100% | 100% | 100% |

| Loss of Both Hands | ||||

| Loss of Both Feet | ||||

| Loss of the Entire Sight of Both Eyes | ||||

| Loss of One Hand and One Foot | ||||

| Loss of Speech and Hearing | ||||

| Loss of One Hand or One Foot and Entire Sight of One Eye | ||||

| Loss due to Hemiplegia | ||||

| Loss due to Paraplegia | ||||

| Loss due to Quadriplegia | ||||

| Loss of One Hand or One Foot | 50% | 50% | 50% | 50% |

| Loss of Entire Sight of One Eye | ||||

| Loss of Speech or Hearing | ||||

| Hearing in One Ear | 25% | 25% | 25% | 25% |

Disclaimers

3 Accidental Death and Dismemberment Benefits are provided as shown in the Schedule of Benefits and pays the member or beneficiary up to the benefit amount listed for the member’s death or dismemberment due to a Covered Accident. Principal Sum will be reduced by 50% on or after a Covered Person’s 70th birthday.

Monthly Rates

| CI-AME-AD&D | ||||

| Level 1 $2,500 | Level 2 $5,000 | Level 3 $7,500 | Level 4 $10,000 |

|

| Member | $63 | $86 | $109 | $131 |

| Member + Spouse | $86 | $141 | $194 | $242 |

| Member + Child(ren) | $68 | $101 | $134 | $164 |

| Member + Family | $104 | $164 | $227 | $282 |

| CI-AD&D | ||||

| Level 1 $2,500 | Level 2 $5,000 | Level 3 $7,500 | Level 4 $10,000 |

|

| Member | $54 | $72 | $92 | $111 |

| Member + Spouse | $69 | $107 | $150 | $189 |

| Member + Child(ren) | $55 | $76 | $101 | $124 |

| Member + Family | $72 | $116 | $161 | $206 |

| AME-AD&D | ||||

| Level 1 $2,500 | Level 2 $5,000 | Level 3 $7,500 | Level 4 $10,000 |

|

| Member | $44 | $52 | $60 | $65 |

| Member + Spouse | $53 | $65 | $79 | $87 |

| Member + Child(ren) | $49 | $59 | $69 | $76 |

| Member + Family | $61 | $79 | $98 | $110 |

| STAND-ALONE AD&D | ||||

| Level 1 $50,000 | Level 2 $100,000 | Level 3 $200,000 | Level 4 $300,000 |

|

| Member | $48 | $57 | $69 | $82 |

| Member + Spouse | $54 | $68 | $93 | $118 |

| Member + Child(ren) | $51 | $62 | $81 | $100 |

| Member + Family | $60 | $80 | $117 | $153 |

FAQ / About the Carrier

About the Carrier

Guarantee Trust Life

With more than 80 years of experience in the insurance industry, Guarantee Trust Life Insurance Company (GTL) has a proud heritage of providing excellent service and superior insurance products to individuals, families and groups across the country.

GTL believes in doing business the right way. They have a consistent track record of successfully delivering on their promises and preserving the trust that their partners, employees and policyholders place in them.

Their mission is to be recognized as a highly-competent, mid-sized mutual insurer, who by bridging timeless virtues with current best business practices, is effective in marketing targeted life and health products across the country.

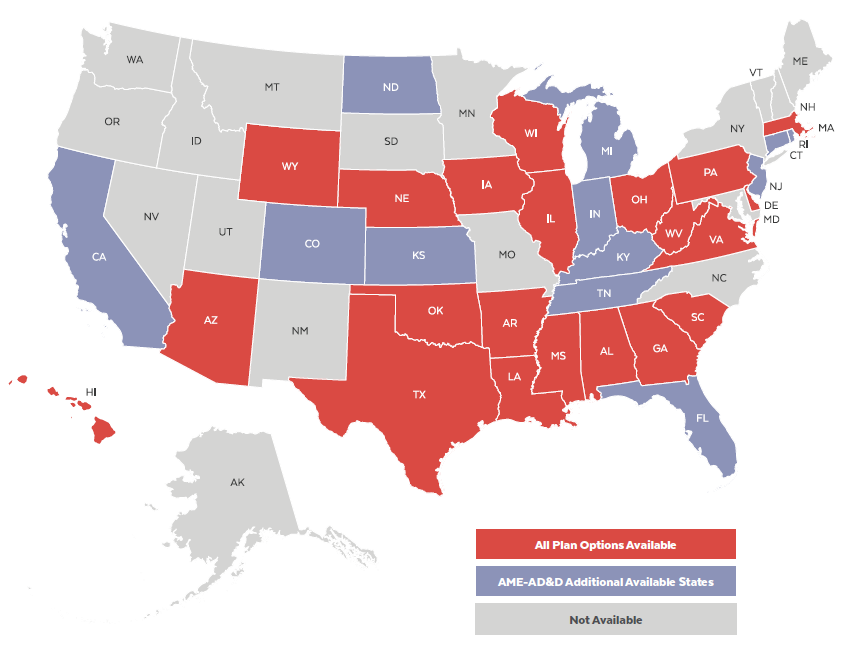

Membership Eligibility

- Between the ages of eighteen (18) and sixty-four (64)

- Reside in an available state

- Dependent children must be under age twenty-six (26)