About HD Tri-Protect

![]()

The HD Tri-Protect membership provides members with access to Term Life, Critical Illness, and Accidental Death & Dismemberment insurance benefits. Having supplemental insurance can help in the event of an unexpected accident or critical illness. Best of all, members can use the cash benefits however they choose—for out-of-pocket medical expenses, transportation costs, help with child care, meals or other household duties or even to pay routine monthly bills.

Click Each Tab Below to Learn More About HD Tri-Protect - Open All Tabs

Association Benefits

Consumer Discounts

Estate Planning Tool

Estate Planning Tool

Creating a will is simple and intuitive using an easy tool with questions about the member and their wishes. Members receive a PDF document that is theirs to download and print with instructions on how to make it official. And once an account is created, members can update and/or edit their will, or generate a new one at any time. FreeWill also includes tools to create an Advance Healthcare Directive, as well as a Durable Financial Power of Attorney.

CLC Legal Access

CLC Legal Access

Through the CLC Legal Access program, our members have access to free initial legal consultations and discounted services to address many common legal concerns. Members also receive simple will preparation and access to online legal resources at no additional cost.

CLC ID Theft & Fraud Resolution

CLC ID Theft & Fraud Resolution

Members and family receive identity theft and fraud resolution services through CLC, Inc. The CLC identity theft resolution program was developed to help guide victims of identity theft and other fraudulent crimes through the complex process of restoring their personal identity, credit rating, financial security, and legal integrity. This benefit includes ID Monitoring, Fraud Restoration, Document Preparation, Lost/Stolen Purse or Wallet Services, Financial Coaching, and Legal Consultation.

Financial Counseling

Financial Counseling

Through My Secure Advantage (MSA), HD members and eligible family members have all the resources needed to feel confident about financial goals in any stage of life – be it growing a family, buying a house, caring for aging parents, or planning retirement.

Health Care Resources

Emergency Medical Air Transport

Emergency Medical Air Transport

At home or abroad, the entire suite of AirMed medical transport benefits is available to Health Depot members on select membership levels without deductibles, claim forms or out-of-pocket expenses.

If a medical emergency occurs while you are hours from home or halfway around the globe, members have seamless access to the highest level of acute care provided by the leading air medical company in North America – AirMed.

Insured Benefits

Group Term Life Insurance

Amalgamated Life Insurance Company

| Group Term Life Insurance | ||

| Underwritten by Amalgamated Life Insurance Company (Policy Form ALTLP-051 or state variations. Features & form numbers may vary by state.) | ||

| INFORMATION YOU NEED TO KNOW | ||

| Guaranteed Coverage | The maximum amount of coverage available during your initial enrollment period with no medical information required. Coverage is for Primary Member only. | |

| Coverage Effective Date | The date your membership in the Health Depot Association becomes effective and you have paid all required dues. | |

| Benefits Waiting Period | There is a 30-day waiting period before you are eligible for benefits. | |

| Benefit1 | Level 1 | Level 2 |

| Coverage (Primary Member) | $10,000 | $15,000 |

| Eligibility | A Member will be eligible for Term Life Insurance if currently an active Member of the Health Depot Association and: Has paid current dues to the Association; Member is actively at work; and Meets the eligibility conditions described in the Certificate. A Member is not eligible if the Member is not actively at work on the day you would normally become eligible. |

|

| Termination of Coverage | A Member's Term Life Insurance Benefit ends on the earliest of: The date the Policy terminates; The date the Member is no longer a member of the association; The last day of the month in which your employment in the eligible class under this policy ends; The date the Member is in active service in the armed forces of a country at war, declared or not; Any applicable premium is due and unpaid. |

|

| Age Reduction | Coverage reduces 35% of the original amount at age 65; 50% of the original amount at age 70. | |

| Accelerated Benefit | If a Member is terminally ill, the Member can receive up to 50% of their life coverage benefit in a lump sum as long as life expectancy is 12 months or less (as diagnosed by a physician). The Accelerated Benefit, less any administrative charge2, will be paid in a lump sum and any remaining Death Benefit under the Certificate will be reduced by the amount of Accelerated Benefit. The amount of any Accidental Death Benefit will not be affected by the payment of the Accelerated Benefit. Premium must continue to be paid for the Insured under the Group Policy after payment of an Accelerated Benefit in order to keep the remaining Certificate Death Benefit in force. Receipt of Accelerated Benefit may affect eligibility for public assistance programs and may be taxable. Please consult a personal tax advisor to determine the tax status of any benefits paid under this rider. |

|

1 Spouse and Child coverage is not available.

2 There is an administrative charge of $75 to process the Accelerated Benefit claim.

Group Accidental Death & Dismemberment Insurance Benefits

Amalgamated Life Insurance Company

| Accidental Death & Dismemberment Insurance Underwritten by Amalgamated Life Insurance Company (Policy Form ALGADDP-10. Features & form numbers may vary by state.) |

||

| Benefit Description | Level 1 | Level 2 |

| Accidental Death & Dismemberment Insurance Benefit | $100,000 | $150,000 |

| Maximum Benefit Amount | ||

| Named Insured (Primary Member)1 | 100% of Principal Sum Face Amount | |

| Schedule of Covered Losses | ||

| Loss of Life | 100% | |

| Loss of Both Hands or Both Feet | ||

| Loss of Sight of Both Eyes | ||

| Loss of Speech and Hearing | ||

| Quadriplegia | ||

| Loss of any two or more: One Hand, One Foot, Sight of One Eye, Speech, Hearing | ||

| Paraplegia | 75% | |

| Hemiplegia | 50% | |

| Loss of One Hand or One Foot | ||

| Loss of Sight of One Eye | ||

| Loss of Speech or Hearing | ||

| Uniplegia | 25% | |

| Additional Benefits | ||

| Airbag Benefit | Lesser of 10% of Insured's Principal Sum; or $10,000 | |

| Emergency Medical Evacuation Benefit3 | Lesser of actual cost of such services; or $10,000 | |

| Higher Education Benefit4 | Lesser of: the actual tuition (exclusive of room and board) charged by that institution for enrollment during that year for that Insured Dependent Child; or 2% of Insured’s Principal Sum on the date of the accident causing death; or $2,500. Maximum benefit period is 4 years per dependent child under age 25. Maximum total of $10,000 per child. | |

| Home Alteration and Vehicle Modification Benefit | Lesser of actual alteration expense; or 2% of Insured's Principal Sum; or $2,500 | |

| Rehabilitation Benefit3 | Lesser of: actual costs incurred for such rehabilitative physical therapy; or 10% of the Insured's Principal Sum; or $10,000 | |

| Repatriation of Remains Benefit | Lesser of the actual cost of such transportation; or $5,000 if the Insured dies as a result of a covered injury sustained outside the US. | |

| Seatbelt Benefit | Lesser of 10% of Insured's Principal Sum; or $50,000 | |

1 Spouse and Child coverage is not available.

3 Not available in MD

4 Not available in NJ

Critical Illness Insurance Benefits

Amalgamated Life Insurance Company

| Individual Critical Illness Insurance Underwritten by Amalgamated Life Insurance Company (Policy Form AMICIP-13. Features & form numbers may vary by state.) |

||

| Benefit Description | Level 1 | Level 2 |

| Critical Illness Insurance Benefit5 | $10,000 | $15,000 |

| Important Information | ||

| Waiting Period | 30 Days | |

| Pre-Existing Conditions Period | 12 Months | |

| Benefit Eligibility for Pre-Existing Conditions | 12 Months after Effective Date | |

| 6 Month Additional Occurrence Benefit | If diagnosed with a different critical illness separated by six months, the appropriate lump sum is payable again. | |

| Recurrence Benefit | The lump sum benefit is payable for a recurrence of the same critical illness separated by 12 months. Limitations apply. | |

| Maximum Benefit Amount | 3 Times Face Amount | |

| Named Insured (Primary Member) | 100% of Face Amount | |

| Schedule of Benefits for Named Insured | ||

| Benign Brain Tumor | $10,000 | $15,000 |

| Invasive Cancer | $10,000 | $15,000 |

| Carcinoma In Situ | $2,500 | $3,750 |

| Skin Cancer | $250 | $250 |

| Coronary Artery Bypass Surgery | $2,500 | $3,750 |

| Angioplasty | $1,000 | $1,500 |

| End Stage Renal Failure | $10,000 | $15,000 |

| Heart Attack (Myocardial Infarction) | $10,000 | $15,000 |

| Major Organ Failure | $10,000 | $15,000 |

| Stroke | $10,000 | $15,000 |

| Traumatic Brain Injury | $10,000 | $15,000 |

| Health Screening Benefit Amount | ||

| Maximum Screenings per Calendar Year | 1 | |

| Named Insured (Primary Member) | $50 | |

Disclaimers

5Benefit reduces 50% at age 70.

Monthly Rates

| Ages | Level 1 | Level 2 |

| 18-24 | $53.50 | $66.50 |

| 25-29 | $59.50 | $72.50 |

| 30-34 | $65.50 | $78.50 |

| 35-39 | $72.50 | $86.50 |

| 40-44 | $86.50 | $104.50 |

| 45-49 | $102.50 | $125.50 |

| 50-54 | $124.50 | $157.50 |

| 55-59 | $160.50 | $204.50 |

| 60-64 | $209.50 | $251.50 |

FAQ / About the Carrier

About the Carrier

Amalgamated Life Insurance Company

About Amalgamated Life

Since its inception in 1943, Amalgamated Life Insurance Company has made its mission to help working people and their families achieve financial security by providing affordable life, health and pension products and services while maintaining an unwavering commitment to excellence.

For more than 40 years, Amalgamated Life has maintained a consistent A.M. Best “A” Rating (Excellent) – a testament to their strong fiscal condition and excellent claims-paying performance.

Experience You Can Trust

Amalgamated Life continually strives to meet the insurance and employee benefit needs of its customers. Their role is to serve working people with the best solutions and equally important, the highest standards of service quality.

Amalgamated Life is a dedicated resource for a broad portfolio of group insurance products, including: disability, medical stop loss, term life and specialty drug cost management services, as well as voluntary benefits, including: accident, accidental death & dismemberment, critical illness, dental, disability, hearing, legal and whole life insurance.

Corporate Social Responsibility

Amalgamated Life exemplifies a true “Best in Class,” leading-edge insurance solution provider committed as ever to meeting the insurance needs of working men and women and their families. The Company is licensed in all 50 states and the District of Columbia.

Membership Eligibility

- Between the ages of eighteen (18) and sixty-four (64)

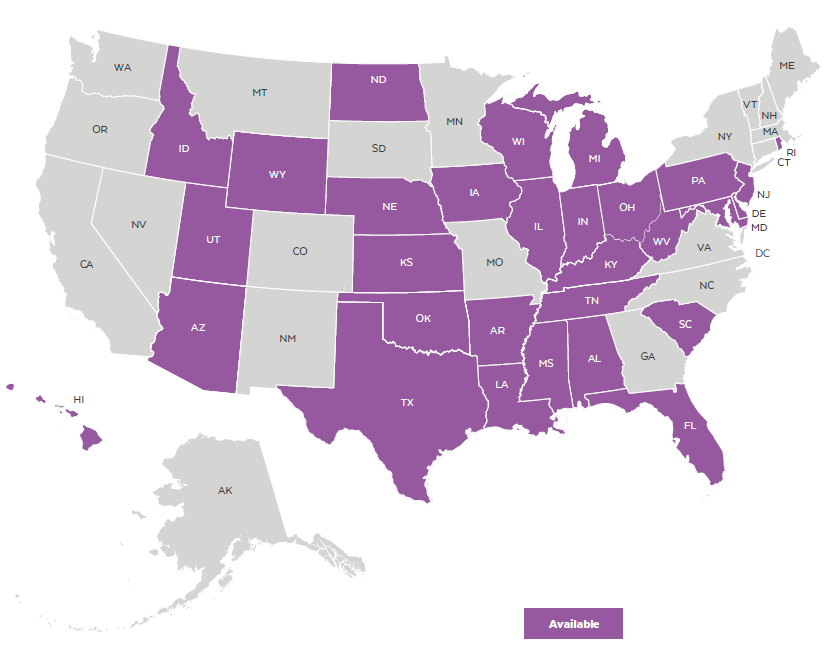

- Reside in an available state

- Must remain a member of the Health Depot Association

- Primary Member Only (No coverage for Dependents)

- Child Only Coverage is Not Available