About HD ClassicProtect

![]() The HD ClassicProtect membership includes discounts and special offers on a variety of Consumer, Business and Health Care programs, services and discounts PLUS Accident and Sickness Limited Benefit insurance to help with out-of-pocket medical expenses, as well as living expenses. And these memberships are offered year round with an option of 5 levels to choose from to best fit your needs.

The HD ClassicProtect membership includes discounts and special offers on a variety of Consumer, Business and Health Care programs, services and discounts PLUS Accident and Sickness Limited Benefit insurance to help with out-of-pocket medical expenses, as well as living expenses. And these memberships are offered year round with an option of 5 levels to choose from to best fit your needs.

Click Each Tab Below to Learn More About HD ClassicProtect - Open All Tabs

Association Benefits

Consumer Discounts

GlobalFit Gym Network

GlobalFit Gym Network

Members receive discounted gym memberships at more than 9,000 gyms nationwide including, L.A. Fitness, Anytime Fitness, Gold’s Gym, 24 Hour Fitness, and local favorites. Members can also take advantage of exclusive member savings on wearable technology, diet resources like Jenny Craig and Nutrisystem, meal plans and diet delivery options, and vitamins and supplements.

Gym America

Gym America

Online access for personalized meal plans tailored to your needs, interactive tools for keeping you on track with fitness and nutrition goals, smart weekly shopping lists and much more for a special price.

Car Rental Discounts

Car Rental Discounts

Take advantage of affordable auto rental rates from Avis® and Budget® Rent A Car.

True Car Auto Buying Service

True Car Auto Buying Service

Save time and money shopping for a new or used car through True Car. Members receive exclusive pricing, price protection and a hassle-free buying experience at thousands of Certified Dealers.

Moving Discounts

Moving Discounts

Cord Moving and Storage Co., an agent for North American Van Lines, offers members valuable discounts on moving and relocation services while providing the highest level of service and customer satisfaction.

Massage Envy

Massage Envy

A spa day isn’t just a way to pamper yourself—a massage can also offer health benefits to many people. Whether you suffer from chronic pain such as headaches and back issues or have a highstress life, a massage may help. Members receive up to 20% off many of the plans and services at Massage Envy.

My Association Savings

My Association Savings

My Association Savings Benefits from Abenity provides members with exclusive perks and over $4,500 in savings on everything from pizza and the zoo, to movie tickets, oil changes, hotels, and car rentals! And, with over 102,000 available discounts across 10,000 cities in the United States and Canada, you’ll never be far from savings!

Popular Features Include:

• Nearby Offers: Use our show & save mobile coupons to quickly access savings on the go.

• eTickets On Demand: Save up to 40% with no hidden fees.

• Show times: Find movies, watch trailers, and save up to 40% at a theater near you.

• Monthly Giveaways: Win cash, movie tickets, electronics and more with our monthly contests.

Health Care Discounts

Hearing Products and Screenings

Hearing Products and Screenings

Members and their immediate family members (grandparents, parents, spouse and children) will receive complimentary hearing screenings and a 15% retail discount off the usual and customary retail price of any Beltone hearing instrument at any of over 1500 locations throughout the United States.

Laboratory Testing

Laboratory Testing

MyMedLab offers an efficient, affordable and confidential solution to medical laboratory testing. You can purchase the same testing ordered by your doctor at a cost 50% to 80% less than in your doctor’s office or local hospital lab.

Testing can be purchased 24 hours a day on the MyMedLab website. Tests are listed both individually and in groups called Wellness Profiles based on your age, sex and family history. This basic information is all you need to identify which profile evaluates your risk for common conditions associated with your specific group.

Diagnostic Testing

Diagnostic Testing

MDsave gives you a better way to buy your medical services, like radiology testing. You get one upfront, easy-to-understand price, which includes the most common fees that go along with your procedure. That means no surprise bills later! Doctors and hospitals partner with MDsave to help you afford your out-of-pocket costs. When you prepay through MDsave, your medical provider is able to offer special pricing on the same quality care because it makes the billing process more efficient.

IDLife Nutritional Products

IDLife Nutritional Products

IDLife products are scientifically formulated to help you by providing therapeutic doses of specific nutrients to:

- Restore nutrients depleted by your Rx program

- Help your body resist Rx side effects

- Improve your overall nutrition status thus optimizing your health

Additionally, they have been pre-screened to avoid drug/nutrient interactions that may be present with your current vitamin program.

Small Business Discounts

NAC Web Services

NAC Web Services

Members can access discounts on website development and maintenance as well as web hosting. Their experienced staff of programmers and graphic designers offer creative and intuitive websites custom-built to your specifications.

UPS Shipping

UPS Shipping

Members receive discounts on UPS delivery services for a variety of next day, 2-day and 3-day shipping options.

Payroll Processing Discounts

Payroll Processing Discounts

Heartland® offers you easy payroll and HR solutions to manage your greatest asset – your employees – while also protecting your business. In addition, they are offering you innovative payment and point of sale solutions to help you run your business better. Heartland can help you streamline operations, increase productivity and make payments easy.

Computer & Digital Equipment

Computer & Digital Equipment

Members can now save up to 30% off the everyday public web price of Lenovo’s entire product line of laptops, tablets, desktops, servers, accessories, and more! Take advantage of great deals on top products for the home and office, including the award-winning ThinkPad laptops and innovative multimode YOGA tablets.

Business Supplies

Business Supplies

Work has changed and this exciting evolution allows for ODP Business Solutions to be more agile and innovative in driving value to your business. You need more than just a supplier in your corner. Members will receive 75% on the Best Value List of preferred products and with free next-business day delivery* or in-store and curbside pickup** when shopping online using a registered account.

Insured Benefits

Accident & Sickness Limited Benefit Insurance

Unified Life Insurance Company

| Benefit Description | ClassicProtect Value | ClassicProtect Level 1 | ClassicProtect Level 2 | ClassicProtect Level 3 | ClassicProtect Level 4 |

| Hospital Confinement Benefit | |||||

| Pays a daily benefit if a Covered Person incurs charges for and is Confined in a Hospital for a period of no less than 20 continuous hours due to injuries received in a Covered Accident or due to a Covered Sickness. This benefit is not payable for emergency room or outpatient treatment. | |||||

| Benefit per Day of Confinement | $250 | $250 | $500 | $750 | $1,000 |

| Maximum Days per Insured per Membership Year | 15 | 15 | 15 | 20 | 30 |

| Hospital Intensive Care Unit Confinement Benefit | |||||

| Pays a daily benefit if a Covered Person incurs charges for and is Confined in a Hospital Intensive Care Unit due to injuries received in a Covered Accident or due to a Covered Sickness. This benefit is payable if the Hospital Confinement benefit is payable and is paid in addition to the Hospital Confinement Benefit. | |||||

| Benefit per Day of Confinement | N/A | $250 | $500 | $750 | $1,000 |

| Maximum Days per Insured per Membership Year | N/A | 3 | 3 | 3 | 3 |

| Additional Hospital Admission Benefit | |||||

| Pays a benefit for the first day of hospitalization if a Covered Person incurs charges for and is Confined in a Hospital for a period of no less than 20 continuous hours due to injuries received in a Covered Accident or due to a Covered Sickness. This benefit is not payable for emergency room treatment. | |||||

| Benefit for the First Day of Hospitalization | N/A | $250 | $500 | $750 | $1,000 |

| Maximum Days per Insured per Membership Year | N/A | 1 | 1 | 1 | 1 |

| Surgery Benefit (percentage of Surgical Fee Schedule)* | |||||

| Pays a benefit for any day a Covered Person undergoes a surgical procedure due to a Covered Accident or Covered Sickness. The procedure must be performed by a board certified surgeon in a Hospital or an Ambulatory Surgical Center. Anesthesia must be administered by a licensed anesthesiologist or certified registered nurse anesthetist (CRNA). | |||||

| % of Surgical Fee Schedule for Any Day in which Surgery is performed on an Inpatient Basis | N/A | N/A | 100% | 125% | 150% |

| % of Surgical Fee Schedule for Any Day in which Surgery is performed on an Outpatient Basis | N/A | N/A | 100% | 125% | 150% |

| Maximum Days in which Inpatient or Outpatient Surgery is Performed per Membership Year | N/A | N/A | 1 | 1 | 1 |

| Anesthesia Benefit - % of Surgical Fee Schedule Per Day of Surgery | N/A | N/A | 25% | 25% | 25% |

| Outpatient Surgical Facility Benefit | |||||

| Pays a daily benefit for any day a Covered Person incurs charges for a surgical procedure performed in an Ambulatory Surgical Center or in a Hospital on an outpatient basis. The charges must be incurred as a result of injuries received in a Covered Accident or due to a Covered Sickness. | |||||

| Benefit Amount per Day | N/A | $200 | $300 | $400 | $500 |

| Maximum Days per Insured per Membership Year | N/A | 1 | 1 | 1 | 1 |

| Doctor Office Visit Benefit | |||||

| Pays a daily benefit for any day a Covered Person incurs charges for and requires a Doctor's office visit due to injuries received in a Covered Accident or due to a Covered Sickness. Visits due to injuries received in a Covered Accident must occur within 72 hours after the date of the Covered Accident. Services must be rendered by a licensed Physician acting within the scope of their license. | |||||

| Benefit Amount per Day | $65 | $65 | $75 | $85 | $100 |

| Maximum Days per Insured per Membership Year | 3 | 3 | 3 | 3 | 3 |

| Diagnostic X-Ray & Laboratory Tests Benefit (including interpretation) | |||||

| Pays a daily benefit for any day a Covered Person incurs charges for diagnostic x-ray and/or laboratory testing caused by a Covered Accident or Covered Sickness. The test must be ordered by a Physician because of a Covered Accident or Covered Sickness and must be performed in a Hospital, Ambulatory Surgical Center, Doctor's office or Diagnostic Center or Facility. This benefit is not payable if Hospital Confinement, Emergency Room or Doctor Office benefit is paid. | |||||

| Benefit Amount per Day for Basic Pathology (laboratory tests) | $25 | $50 | $65 | $75 | $100 |

| Benefit Amount per Day for Basic Radiology (x-rays, ultrasounds and other medical imaging) | |||||

| Benefit Amount per Day for Advanced Studies (MRI, CT, PED and other advanced scans) | |||||

| Maximum Benefit for All Basic Pathology, Basic Radiology and Advanced Studies Combined per Insured per Year | 2 | 2 | 2 | 3 | 3 |

| Emergency Room Visits Benefit | |||||

| Pays a daily benefit for any day a Covered Person incurs charges for and requires medical care from an emergency room due to injuries received in a Covered Accident or due to a Covered Sickness. Services must be rendered by a Physician. Visits due to injuries received in a Covered Accident must occur within 72 hours after the date of the Covered Accident. Benefit will not be payable if Covered Person is confined in a Hospital as a result of the injuries received in the Covered Accident or due to the Covered Sickness that caused the visit to the Emergency Room. | |||||

| Benefit Amount per Day | N/A | $100 | $150 | $200 | $250 |

| Maximum Days per Insured per Membership Year | N/A | 1 | 1 | 1 | 1 |

| Ambulance Benefit | |||||

| Pays a benefit for any day a licensed professional ambulance company transports a Covered Person by ground transportation to or from a Hospital or between medical facilities, where treatment is received as the result of a Covered Sickness or Accident. The ambulance transportation must be within 90 days after a Covered Sickness or Accident. Benefit is payable once per Covered Sickness or Accident. | |||||

| Benefit Amount per Day | N/A | $100 | $150 | $200 | $250 |

| Maximum Days per Insured per Membership Year | N/A | 1 | 1 | 1 | 1 |

Disclaimers

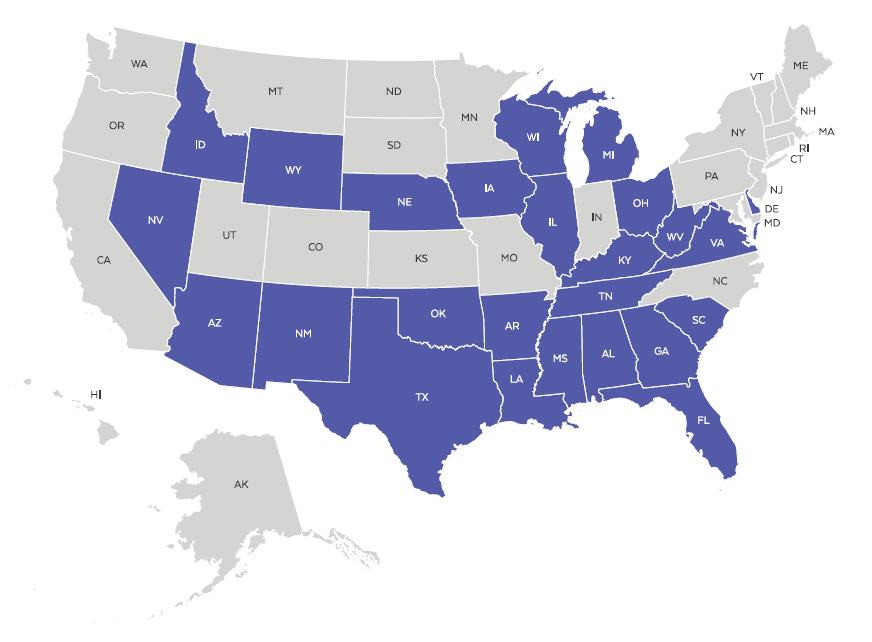

There is a 30-day waiting period for sickness on the Accident and Sickness Limited Benefit Health Insurance. Not applicable for residents of Idaho and Texas.

* The Surgery Benefit pays a flat dollar amount, based on the Surgical Fee Schedule, in ID, NE, OH, and TN. The benefits per membership level are as follows: Value – N/A, Level 1 – N/A, Level 2 – up to $850, Level 3 – up to $1,075, Level 4 – up to $1,300. Anesthesia remains 25% of surgery benefit in these states.

Monthly Rates

| Value | Level 1 | Level 2 | Level 3 | Level 4 | |

| Member | $179 | $219 | $319 | $419 | $459 |

| Member + Spouse | $252 | $319 | $499 | $669 | $759 |

| Member + Child(ren) | $242 | $299 | $464 | $622 | $699 |

| Member + Family | $309 | $389 | $629 | $852 | $972 |

FAQ / About the Carrier

About the Carrier

Unified Life Insurance Company

Unified Life Insurance Company is a stock life insurance company with over thirty years of experience in the fields of life, health and annuity insurance and reinsurance.

First incorporated in Texas in 1986, Unified Life has been providing valuable coverage and protection to consumers for over three decades, boasting stability and a positive financial outlook (B++) from industry rating firm AM Best.

From the beginning, Unified Life has focused on community service as a guiding principle. They believe in a responsibility to give back to their neighbors and to foster support for a variety of causes.

The mission of Unified Life is keeping promises that have been made to policyholders. They do this by being fair, equitable and efficient and striving for the highest level of integrity. Unified Life wants to be there for policyholders when needed most. Because it’s better when you’re Unified.

Membership Eligibility

• Between the ages of eighteen (18) and sixty-four (64)

• Reside in an available state

• Dependent children must be under the age of twenty-six (26)

Health Care Discounts Disclosure

Not available in AK, IL, OK, UT, VT, WA. If you move to one of those states, your discount medical benefits will terminate.

The discount medical, health, and drug benefits of this Plan (The Plan) are NOT insurance, a health insurance policy, a Medicare Prescription Drug Plan or a qualified health plan under the Affordable Care Act. The Plan provides discounts for certain medical services, pharmaceutical supplies, prescription drugs or medical equipment and supplies offered by providers who have agreed to participate in The Plan. The range of discounts for medical, pharmacy or ancillary services offered under The Plan will vary depending on the type of provider and products or services received. The Plan does not make and is prohibited from making members' payments to providers for products or services received under The Plan. The Plan member is required and obligated to pay for all discounted prescription drugs, medical and pharmaceutical supplies, services and equipment received under The Plan, but will receive a discount on certain identified medical, pharmaceutical supplies, prescription drugs, medical equipment and supplies from providers in The Plan. You may call (214) 436-8882 or email customerservice@premierhsllc.com for more information or visit myhealthaccountmanager.com for a list of providers. The Plan will make available before purchase and upon request, a list of program providers and the providers’ city, state and specialty, located in the member’s service area. The fees for The Plan are specified in the membership agreement.

Note to MA consumers: The discount plan is not insurance coverage and does not meet the minimum creditable coverage requirements under M.G.L. c. 111M and 956 CMR 5.00.