Features

- Average savings of 60%, with potential savings of up to 80% or more (based on 2018 national program savings data)

- Accepted at over 65,000 participating pharmacies nationwide, including major chains and independent pharmacies

- Can be used for all prescription drugs, both brand-name drugs and generics

- Members will always receive the lowest price available on prescription medications

Savings

- THOSE WITH LIMITED INSURANCE OR NO PRESCRIPTION COVERAGE can reduce out of pocket costs

- THOSE WITH HEALTH INSURANCE, MEDICARE, OR HIGH DEDUCTIBLE HEALTH PLANS can reduce the cost of medications that are not covered by insurance, or can possibly find a lower price than their insurance copay

- THOSE WITH PETS can reduce their out-of-pocket costs on human-equivalent pet medications

Honored at Over 65,000 Participating Pharmacies, Including:

Plus Thousands of Additional Chains and Independent Pharmacies Nationwide.

Locate participating pharmacies and look up drug pricing at www.hdarx.com.

DISCOUNT ONLY - NOT INSURANCE. Discounts are available exclusively through participating pharmacies. The range of the discounts will vary depending on the type of prescription and the pharmacy chosen. The program does not make payments directly to the pharmacies. Members are required to pay for all prescription purchases. The prescription savings card does not coordinate with an insured prescription plan. You may contact customer care with questions or concerns, or to obtain further information. This program is administered by Medical Security Card Company, LLC, Tucson, AZ.

Benefit Summary

Founded in 2002, Teladoc is a national network of physicians who use electronic health records, telephone consultations and online video consultations to diagnose, recommend treatment and write short-term, non-DEAcontrolled prescriptions, when appropriate. Teladoc doctors have an average of 15 years of practice experience and are board-certified in internal medicine, pediatrics and family medicine. Consultations are available 24/7/365 with no fees and no time limit, allowing members to access quality care from wherever they are as opposed to more traditional and expensive settings like the doctor’s office, urgent care or emergency room.

From your home, office, hotel room, or vacation campsite, simply make a phone call, and in most cases, speak to a doctor in less than 30 minutes, with an average call back time of less than 10 minutes. When you call Teladoc, you will always speak to a doctor who lives and works in the United States and is licensed to practice medicine in your state. Teladoc is also the only telemedicine provider able to treat children from 0-17¹ . It’s health care that fits in the palm of your hand.

member satisfaction rate with Teladoc.

of Teladoc members resolved their medical issue with Teladoc

Call Teladoc

- When your physician is not available

- For non-emergent medical care

- After normal hours of operation

- When on vacation or a business trip

- For second opinions

- To avoid germ filled waiting rooms

- Instead of missing work

Teladoc Treats Non-Emergency Medical Issues such as:

- Cold and Flu symptoms

- Bronchitis

- Allergies

- Poison Ivy

- Pink eye

- Urinary tract infection

- Respiratory infection

- Sinus problems

- Ear infection

- and more!

Teladoc is simply a more convenient way for you to resolve many of your medical issues.

¹Consults for children under the age of 18 must be accompanied by a parent, guardian, or approved consenter.

First consult in AR and DE will be by video, after that it can be phone or video.

© 2017 Teladoc, Inc. All rights reserved. Teladoc and the Teladoc logo are registered trademarks of Teladoc, Inc. and may not be used without written permission. Teladoc does not replace the primary care physician. Teladoc does not guarantee that a prescription will be written. Teladoc operates subject to state regulation and may not be available in certain states. Teladoc does not prescribe DEA controlled substances, non-therapeutic drugs and certain other drugs which may be harmful because of their potential for abuse. Teladoc physicians reserve the right to deny care for potential misuse of services.

VERY IMPORTANT: IN LIFE THREATENING EMERGENCIES, CALL 911 or go directly to the nearest hospital emergency room for treatment. If 911 is not available in your area, call the local police/fire department or go directly to the nearest hospital or emergency room.

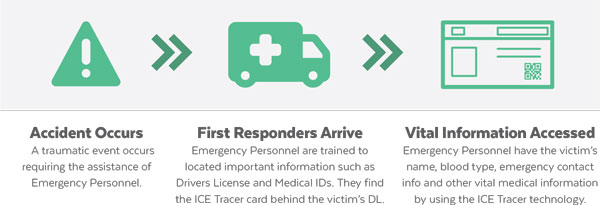

How Does it Work?

Lifesaving information on the View Profile consists of:

- Identifying Member Information

- Emergency Contacts

- Physicians

- Insurance Details

- Medical History

- Medications

- Hospitalizations

As a Health Depot Association member you receive a free monthly membership to ICE Tracer. Your membership also allows you to add and manage family members. Durable, plastic cards are available for purchase within your account at a discounted rate of $5.00 each.

Don’t leave your emergency treatment to chance, sign up for ICE Tracer today!

CVS Caremark is a pharmacy management company that has contracted discounts at over 67,000 pharmacies nationwide. Members can save an average of 20% on the usual and customary pharmacy retail prices on generic to brand drugs, with the highest percentage savings on generic drugs. It should be noted that savings will vary depending on the specific prescription drug purchased and where it is purchased.

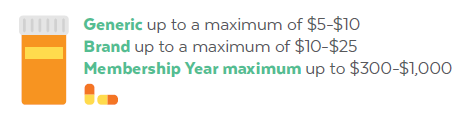

Your HD Protection Plus membership includes an insured prescription benefit as outlined below.

Outpatient Prescription Drug Benefit

Visit www.cvshdrx.com to locate participating pharmacies and access the online drug pricing tool. The drug pricing tool will assist you in anticipating your potential drug costs. Each membership level has its own drug pricing tool that corresponds with the prescription drug benefit amounts and calendar year maximum.

Insured Benefit

By using your membership access to the CVS/Caremark pharmacy network, you can stretch the benefit dollars you may have under a health plan and/or the prescription drug benefits available under the Blanket Group Specified Disease/Illness and Blanket Group Accident Insurance included as part of your Health Depot Protection Plus membership.

For example, if you go to a CVS/Caremark pharmacy and have a generic prescription drug filled at a network price of $10 and you have a $10 prescription drug benefit available under a health plan or the Blanket Group Specified Disease/Illness and Blanket Group Accident Insurance included with your membership, then, your cost would be $0.

(Freedom Life Insurance Company of America and the insurance benefits they underwrite are not affiliated or associated with CVS/Caremark.)

Facts about Generic Drugs

- The average cost of a generic drug is 80-85% less than its brand-name counterpart.

- Nearly 8 in 10 prescriptions filed in the U.S. are for generic drugs.

- FDA requires generic and brand-name drugs to have the same active ingredient, strength, dosage form, and route of administration.

- The generic manufacturer must prove its drug is the same (bioequivalent) as the brand-name drug.

- All manufacturing, packaging, and testing sites must pass the same quality standards as those of brand-name drugs.

- Many generic drugs are made in the same manufacturing plants as the brand-name drugs.

The Principal Financial Group® (The Principal®) is a global investment management leader offering retirement services, insurance solutions and asset management. The Principal offers businesses, individuals and institutional clients a wide range of financial products and services, including retirement, asset management and insurance through its diverse family of financial services companies.

As a premier provider of employee benefits, the Principal Financial Group offers group disability, life, vision and dental insurance to growing companies across the United States.

Founded in 1879 and a member of the FORTUNE 500®, the Principal Financial Group has $513.5 billion in assets under management and serves some 19.5 million customers worldwide from offices in Asia, Australia, Europe, Latin America and the United States.

Principal Life Insurance Company

Life insurance provides a degree of financial protection against the certainty of death and can help survivors achieve specified financial objectives. Life insurance death benefits can be used to pay off a mortgage, provide funds for childcare, college educations and more.

Term Life Benefit

| GROUP TERM LIFE INSURANCE | Underwritten by Principal Life Insurance Company, Inc. | |

|---|---|

| Benefit Description | |

| Term Life Insurance Benefit | $10,000 |

| Important Information | |

| Guaranteed Coverage | The maximum amount of coverage available during your initial enrollment period with no medical information required. Coverage is for Primary Member only. |

| Coverage Effective Date | The date your membership in the Health Depot Association becomes effective and you have paid all required dues. |

| Benefit Waiting Period | There is a 60 day waiting period before you are eligible for this benefit. |

This summary of coverage provides a brief description of some of the terms, conditions, exclusions and limitations of the Association’s Policy. Definitions of capitalized terms in this Summary of Coverage can be found in the Certificate. For a complete description of the terms, conditions, exclusions and limitations of the Association’s Policy, refer to the appropriate section of the Certificate. In the event of a discrepancy between this Summary of Coverage and the Certificate, the Certificate will control. For a copy of the Certificate, contact the Association or Benefits Administrator. This Summary of Coverage is not a contract. Members are not necessarily entitled to insurance under the Policy because they received this Summary of Coverage. Members are only entitled to insurance if they are eligible in accordance with the terms of the Certificate.

Group Term Life Benefit Summary

Eligibility

You are eligible if you are an active Member of the Health Depot and:

- You have paid current dues to the association;

- You meet the eligibility conditions described in the Certificate.

A Member is not eligible if the Member is:

- Totally Disabled;

- Confined in a Hospital as an inpatient;

- Confined in any institution or facility other than a Hospital; or

- Confined at home and under the care or supervision of a Physician

On the day insurance is to begin. Insurance will not take effect until the first day of the month that follows the day after the

member is no longer confined. In addition, insurance for a Member who is unable to perform two or more Activities of daily

living (ADLs), whether or not confined, will not take effect until the first day of the month that follows the day the Member has

performed all the ADLs for at least 15 consecutive days.

Termination of Coverage

Your Life Insurance Benefit ends on the earliest of the day:

- the date the Policy terminates;

- the date you are no longer a Member of the association;

- the end of the month in which you turn age 65;

- you enter the Armed Forces, National Guard or Reserves of any state or country on active duty (except for temporary

- any applicable premium is due and unpaid;

- you do not satisfy any other eligibility conditions described in the Certificate.

active duty of two weeks or less);

Accelerated Benefit

If you are terminally ill you can receive up to 75% of your life coverage benefit in a lump sum as long as:

- your life expectancy is 12 months or less (as diagnosed by a physician), and

- your death benefit is at least $10,000.

When you use the accelerated benefit, your death benefit is reduced by the accelerated benefit payment. There are possible tax consequences to receiving an accelerated benefit payment. You should contact your tax advisor for details. Receipt of accelerated benefits could also affect eligibility for public assistance. The charge for this benefit is included in your premium.

Coverage Outside United States

Benefits will not be paid if you are outside the United States for certain reasons for more than six months

Group Term Life coverage is not available for residents of Alaska, Colorado, Maine, Montana, New York and Oregon.

Healthcare starts with Compass

Compass Professional Health Services is your champion for simpler, smarter healthcare. Compass can help you lower your healthcare costs while maintaining or improving the quality. With their unparalleled expertise in price transparency and patient advocacy services, Compass returns control to the patient in a way that benefits the entire healthcare system.

Better Care + Lower Costs = Happier Patients

One hospital might charge $1,500 for an MRI, while another charges $500—in the same city. Compass can help you make sense of medical treatment options and costs. From finding doctors to getting cost estimates to solving billing problems, Compass will serve as your personal healthcare advisor. You can rely on your Compass Health Pro® consultant to make you an empowered healthcare consumer who takes control of healthcare costs.

Compass’ service is simple to use and available to you & your family

Understand Insurance Benefits

Receive guidance in understanding your benefits throughout the year.

Find a Great Doctor

Find the best doctors, dentists and eye care professionals in your area who meet your personal preferences and healthcare needs.

Save Money on Medical Care

Get price comparisons before receiving care. Depending on the doctor, hospital or facility, costs can vary by hundreds or thousands of dollars — even in-network.

Pay Less for Prescriptions

Let Compass compare medication prices and explore lower-cost options for you.

Get Help with Medical Bills

Have your medical bills reviewed to make sure you are not overcharged.

Reasons to contact Compass right now.

- Struggling to understand your medical and benefits plan? Let Compass help you understand how your plan actually works.

- Moved recently or looking for a new provider? We’ll find great doctors, dentists and eye care professionals for you and your family

- Need an annual physical? We’ll locate the rightdoctor and set up your appointment.

- Upcoming medical procedure? We’ll estimate your out-of-pocket costs to ensure you pay a fair price.

- Tired of overpaying for brand-name prescriptions? Let Compass research the most cost-effective options for the prescriptions you’re taking.

- Wondering if a medical bill is correct? We’ll make sure you’re not overbilled.

| Vision Service | Participating Provider Benefit Amount Covered by the Plan | Non-Participating Provider Benefit Amount Reimbursed by the Plan |

|---|---|---|

| Annual Eye Exam | Covered in Full after $20 deductible | $20 |

Vision Benefits

The MES Vision Program has been developed to provide affordable eye examinations and eyewear for Members. Members receive one comprehensive vision examination every 12 months, after a $20 exam deductible has been paid to the participating provider. If you go to a non-participating provider, you will pay for the exam at the time of service and then file a claim to receive a $20 reimbursement.

Vision Program Benefits

Members and their families also receive a 20% discount¹ off the usual and customary charges for eyewear at any of the participating providers at the time of service. There are no authorizations or claim forms required. In order to receive the discount benefit, members identify themselves as MES Vision Program members at time services are rendered. There are no limits to the number of times the discount can be used.

The discount may be applied to:

- Lenses (single vision, bifocal, trifocal, hi-index, progressive, etc.)

- Frames

- Contact Lenses (see Exclusions)

- Photochromic Lenses

- Tints and Coatings

Locate Participating Providers

To locate participating vision care providers in your area, visit: www.ECNdiscount.com.

Additional Discounts

Discounted Contact Lenses are available through MESVision OPTICS. Discounts for conventional and custom LASIK procedures² are available through the TLCVision Advantage Program.

EXCLUSIONS

¹The discount does not apply to disposable, extended wear or frequent replacement contact lenses; frame repairs; promotional eye care or eyewear offers; medical/surgical treatment of the eyes; and services or materials provided by non-participating providers. There are no retroactive discounts allowed.

²LASIK vision correction is an elective procedure, performed by specially trained providers; therefore, this discount may not always be available from a provider in your immediate location.

Underwritten By:

Gerber Life Insurance Foundation

Gerber Life Insurance Foundation

A separate subsidiary of Gerber Products

Home Office: White Plains, NY 10605