This membership plan includes the First Health Limited Benefit Network. Members have access to a premier national network, which offers:

Broad Access - Choice of nearly 5,100 hospitals, 110,000 ancillaries and more than 695,000 healthcare professionals.

Great Discounts - With average savings of 32-52%** for the most commonly used medical providers/services, Health Depot members benefit from lower out-of-pocket costs through the First Health Network.

Consistent Quality - As a PPO network accredited by the National Committee for Quality Assurance (NCQA), First Health is known for network stability. In fact, 99 percent of our hospitals and 94 percent of our physicians are retained year after year.*

Find In-Network Providers and Facilities

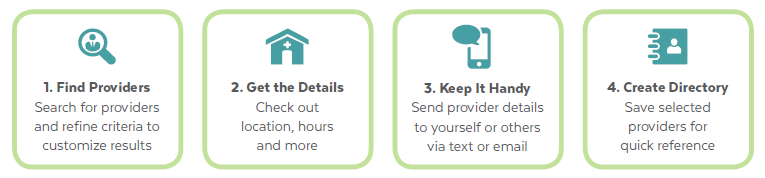

First Health has made finding a health care provider even easier! With the improved Provider Online Search tool, you can quickly and easily locate network providers and make educated health care choices. Go to www.firsthealthlbp.com and follow the steps below to search for a provider and create a provider directory.

If you need more help, select “Contact Us” on the lower left side of the web page to submit an online request. First Health’s Customer Service team will get back to you within 48 hours. Or, you may call (800) 226-5116 Monday through Friday from 8 a.m. to 8 p.m. (Eastern Time). Identify yourself as a health plan participant accessing First Health Limited Benefit Plan Network.

Confirm Participation in the First Health Network

Always check with the provider’s office before scheduling an appointment or getting services and confirm that they are still a participating provider in the First Health Limited Benefit Plan network. Participating physicians, hospitals and other health care providers are independent contractors. They are neither agents nor employees of First Health. The availability of any particular provider cannot be guaranteed. Provider networks are subject to change.

* Network statistics as of December 2017 First Health Data Warehouse.

** Savings shown represent average savings achieved from actual claims data set representative of 12 months of claims history. Discounts do not account for any savings based on benefit plan design or member responsibility. Actual discounts vary by provider and specific geographic locations.

First Health is a brand name of First Health Group Corp. First Health Group Corp. is an indirect, wholly owned subsidiary of Aetna, Inc.

How to Use Your Vision Plan

Using a vision plan administered through MESVision® is easy . . .

Just follow these three simple steps:

1. Select a provider.

Select a participating vision care provider by using the MESVision® provider search feature on our website at www.MESVision.com. Obtaining services from a Participating Provider will maximize your benefits.

2. Make an appointment.

Make an appointment with the Participating Provider of your choice and inform them of your vision coverage.

3. You’re done!

Your participating vision care provider will take care of the rest. The Participating Provider will contact MESVision® to verify your eligible benefits and submit a claim for services covered by your plan.

Features

- Eyeglasses manufactured in US

- Top brands like Varilux no-line bifocals and Transitions Lenses

- Polycarbonate lenses

- Scratch-resistant coating

- 100% UV coating

- Polished lenses

EyeBucks Rewards

When members order from 39DollarGlasses.com, they are automatically enrolled in the EyeBucks Rewards program. 4% of their purchases will be deposited into their customer account for future purchases. Members simply go to "My Account" to see how much they have earned!

Find a MultiPlan Limited Benefit Plan Network Provider

MultiPlan can help you find the provider of your choice. Simply call MultiPlan's Customer Service Monday through Friday from 8 a.m. to 8 p.m. (Eastern Standard Time) and identify yourself as a health plan participant accessing MultiPlan Network for Limited Benefit plans. You may also search online at www.multiplan.com:

- Click on Find a Provider

- Click on the Select Network button and choose MultiPlan

- Click on Limited Benefit Plan

- Type in your search criteria and location

- If you are currently seeing a doctor or other healthcare professional who does not participate in the MultiPlan Limited Benefit Network, you may use the Online Provider Referral System. On the Home page, click on Information for Health Plan Members, and then click on Nominate a Provider, which allows you to nominate the provider in just minutes using an online form. When you complete the form, MultiPlan will contact your nominee to determine whether the provider is interested in joining. If so, they will follow up to recruit the provider.

Confirm Participation in the MultiPlan Network

It is your responsibility to confirm your provider or facility’s continued participation in the MultiPlan Limited Benefit Plan Network and accessibility under your benefit plan. When scheduling your appointment, specify that you have access to the MultiPlan Network through your Health Depot membership plan, confirm the provider’s current participation in the MultiPlan Limited Benefit Plan Network, their address and that they are accepting new patients. Please also be sure to follow any preauthorization procedures required by your plan (usually a telephone number on your ID card). In addition, to ensure proper handling of your claim, always present your current benefits ID card upon arrival at your appointment.

Please note: MultiPlan, Inc. and its subsidiaries are not insurance companies, do not pay claims and do not guarantee health benefit coverage.

Quality Dentist Access

United Concordia’s large network of dentists consists of nearly 107,000 dentists around the country. Their extensive, ongoing recruitment efforts ensure that members can easily find a nearby network dentist, no matter where they live. United Concordia holds their dentists to the highest standards, rigorously screening their credentials and claims to verify quality care is provided to all members.

What is a Network Dentist?

Network dentists agree to accept United Concordia’s discounted fees as payment in full for covered services. Non-network dentists can charge you more. This means you will lower your out-of-pocket expense using a network dentist.

You can receive care from any licensed dentist. But your benefits may differ and your out-of-pocket costs could be higher with a non-network dentist.

Save Money & Time

A network dentist saves you the difference between the negotiated fees and the dentist’s regular charges. And, you stretch your benefit dollars by getting more services before reaching your annual maximum. Network dentists also file your claims for you, saving you time and the hassle of paperwork.

Savings Example1

| Member’s Annual Dental Care | Example Dentist Charge | Network Dentist Visit — Member Responsibility2 | Non-network Dentist Visit — Member Responsibility | Member Savings for Visiting a Network Dentist |

|---|---|---|---|---|

| 2 Cleanings | $151 | $0 | $63 | $63 |

| 2 Exams | $85 | $0 | $45 | $45 |

| 1 Set x-rays | $117 | $0 | $59 | $59 |

| 2 Composite fillings | $227 | $22 | $149 | $127 |

| 1 Crown | $931 | $324 | $611 | $287 |

| Total | $1,512 | $346 | $928 | $582 |

- Savings estimates based on internal data for zip code 17110, as of 6/15; savings will vary by dentist, service and geographic region.

- All services performed by an Advantage Plus 2.0 network dentist.

Locate Participating Providers

To locate participating dental providers in your area, visit: www.unitedconcordia.com/find-a-dentist/ and select the Advantage Plus 2.0 network.