About AWA SecureElite

![]()

The AWA SecureElite membership provides members with access to supplemental Critical Illness and/or Group Accident Only Insurance benefits. Having supplemental insurance can help in the event of an unexpected accident or critical illness. Best of all, members can use the cash benefits however they choose- for out-of-pocket medical expenses, transportation costs, help with child care, meals or other household duties or even to pay routine monthly bills.

*Association non-insured benefits vary by level. Consult member guide for more details.

Affiliated Workers Association (AWA) and Guarantee Trust Life Insurance Company (GTL) are separate legal entities and have sole financial responsibility for their own products.

Click Each Tab Below to Learn More About AWA SecureElite - Open All Tabs

Association Benefits

Consumer Discounts

Estate Planning Tool

Estate Planning Tool

Creating a will is simple and intuitive using an easy tool with questions about the member and their wishes. Members receive a PDF document that is theirs to download and print with instructions on how to make it official. And once an account is created, members can update and/or edit their will, or generate a new one at any time. FreeWill also includes tools to create an Advance Healthcare Directive, as well as a Durable Financial Power of Attorney.

Travel Savings

Travel Savings

Personal service and best prices on travel! Member pricing is GUARANTEED to be lower than those “public” websites. TravCredits™ are designed to reduce the price of hotels, resorts, and condominiums. TravNow™ reveals the retail rate of a specific property, then allows members to use their TravCredits™ to “buy down” the retail website rate. Whether planning a business trip, family vacation, or road trip with that someone special, TravNow™ has literally hundreds of thousands of hotels to choose from, worldwide.

CLC ID Theft & Fraud Resolution

CLC ID Theft & Fraud Resolution

Members and family receive identity theft and fraud resolution services through CLC, Inc. The CLC identity theft resolution program was developed to help guide victims of identity theft and other fraudulent crimes through the complex process of restoring their personal identity, credit rating, financial security, and legal integrity. This benefit includes ID Monitoring, Fraud Restoration, Document Preparation, Lost/Stolen Purse or Wallet Services, Financial Coaching, and Legal Consultation.

CLC Legal Access

CLC Legal Access

Through the CLC Legal Access program, our members have access to free initial legal consultations and discounted services to address many common legal concerns. Members also receive simple will preparation and access to online legal resources at no additional cost.

MSA Financial Coaching

MSA Financial Coaching

Through My Secure Advantage (MSA), AWA members and eligible family members have all the resources needed to feel confident about financial goals in any stage of life – be it growing a family, buying a house, caring for aging parents, or planning retirement.

Tax Preparation

Tax Preparation

Through Trupoint Tax Service, members have 2 options for easily filing their tax return – do it themselves or save time and hassle by having a tax professional complete it for them. The DIY option is only $25 per return. Members who don’t want to do their own return can use the mobile filing option with the assistance of a certified tax professional, which allows members to file their taxes anytime, anywhere in 10 minutes or less. Fees for the mobile filing option start at $150, but members will receive an estimate of the total fees that will apply after their submission has been reviewed.

Health Care Discounts

Emergency Medical Air Transport

Emergency Medical Air Transport

At home or abroad, the entire suite of AirMed medical transport benefits is available to AWA members* without deductibles, claim forms or out-of-pocket expenses.

If a medical emergency occurs while you are hours from home or halfway around the globe, members have seamless access to the highest level of acute care provided by the leading air medical company in North America – AirMed.

*Must be enrolled on an AWA membership that includes AirMed.

IDLife Nutritional Products

IDLife Nutritional Products

IDLife products are scientifically formulated to help you by providing therapeutic doses of specific nutrients to:

- Restore nutrients depleted by your Rx program

- Help your body resist Rx side effects

- Improve your overall nutrition status thus optimizing your health

Additionally, they have been pre-screened to avoid drug/nutrient interactions that may be present with your current vitamin program.

Wellness Resource

Wellness Resource

A multifaceted health and wellness resource providing members with extensive nutrition, fitness, stress management, sleep wellness, and supplementation information. Members have access to wellness articles, fitness video archive, personalized healthy meal guide generator, relaxing sleep wellness sounds, 20+ high value wellness brand discounts, wellness assessments, an alternative medicine practitioner finder, and more.

Insured Benefits

Guarantee Trust Life Insurance Company

| GROUP ACCIDENT ONLY INSURANCE PLANSUnderwritten by Guarantee Trust Life Insurance Company (GTL)Policy Form MP-1400 (or MP-1300) issued to Affiliated Workers Association | ||||

| Benefit Description | Level 1 | Level 2 | Level 3 | Level 4 |

| Accident Medical Expense Benefit (AME)1 | ||||

| Maximum Amount per Covered Accident | $2,500 | $5,000 | $7,500 | $10,000 |

| Deductible per Covered Accident | $250 | $250 | $250 | $250 |

| Initial Treatment Period | 60 Days | 60 Days | 60 Days | 60 Days |

| Benefit Period | 12 Months | 12 Months | 12 Months | 12 Months |

| Covered Charges | ||||

| Hospital room and board, and general nursing care, up to the semiprivate room rate | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Hospital miscellaneous expense during Hospital Confinement or for outpatient surgery under general anesthetic, such as the cost of the operating room, laboratory tests, x-ray examinations, anesthesia, drugs (excluding take-home drugs) or medicines, therapeutic services and supplies | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Doctor's fees for surgery | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Anesthesia services | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Doctor's visits, inpatient and outpatient, each visit | $75 | $75 | $75 | $75 |

| Hospital Emergency care | $500 | $500 | $500 | $500 |

| X-ray and other diagnostic tests | $250 | $250 | $250 | $250 |

| Ambulance expense | $250 | $250 | $250 | $250 |

| Durable Medical Equipment | $100 | $100 | $100 | $100 |

| Prescription Drugs | $500 | $500 | $500 | $500 |

| Dental treatment for Injury to Sound Natural Teeth | $250 per tooth, up to a maximum of $500 | $250 per tooth, up to a maximum of $500 | $250 per tooth, up to a maximum of $500 | $250 per tooth, up to a maximum of $500 |

| Physical Therapy | $60 for first visit; $30 for each visit thereafter | $60 for first visit; $30 for each visit thereafter | $60 for first visit; $30 for each visit thereafter | $60 for first visit; $30 for each visit thereafter |

| Registered Nurse expense | up to $2,500 | up to $5,000 | up to $7,500 | up to $10,000 |

| Accidental Death & Dismemberment Benefit (AD&D)2 | ||||

| Principal Sum - Member, Spouse, Child(ren) | $2,500 | $5,000 | $7,500 | $10,000 |

| Schedule of Benefits | ||||

| Loss of Life | 100% | 100% | 100% | 100% |

| Loss of Both Hands | ||||

| Loss of Both Feet | ||||

| Loss of the Entire Sight of Both Eyes | ||||

| Loss of One Hand and One Foot | ||||

| Loss of Speech and Hearing | ||||

| Loss of One Hand or One Foot and Entire Sight of One Eye | ||||

| Loss of One Hand or One Foot | 50% | 50% | 50% | 50% |

| Loss of Entire Sight of One Eye | ||||

| Loss of Speech or Hearing | ||||

| Loss of Hearing in One Ear | 25% | 25% | 25% | 25% |

Disclaimers

1 Accident Medical Expense Benefit does not pay for reinjury or complications of an injury caused or contributed to by a condition that existed before the Accident.

This benefit pays in excess of any other insurance coverage you may have for the expenses you are charged by a hospital, doctor, or certain other charges, up to a maximum of the amount listed if you are injured in a Covered Accident. GTL will pay based on the Reasonable and Customary charges for Medically Necessary treatment of a Covered Injury incurred by the Covered Person resulting from a Covered Accident, after the $250.00 Deductible is satisfied. The first treatment or service must occur within 60 days of the Covered Accident and all subsequent treatments must be incurred within 12 Months of the Covered Accident. Benefits will be paid up to the amount stated in the Schedule of Benefits.

2 Accidental Death and Dismemberment Benefits are provided as shown in the Schedule of Benefits and pays the member or beneficiary up to the benefit amount listed for the member’s death or dismemberment due to a Covered Accident.

The Accidental Death & Dismemberment benefit pays the amount shown if you suffer a Covered Loss resulting from a Covered Accident. If you sustain more than one Covered Loss as a result of the same Covered Accident, only the largest available benefit will be paid. If the loss results in death, benefits will only be paid under the Loss of Life benefit provision.

Percentages relate to the Principal Sum benefit as shown above for the Primary, Spouse and Child(ren).

Guarantee Trust Life Insurance Company

| GROUP ACCIDENT ONLY INSURANCE PLANSUnderwritten by Guarantee Trust Life Insurance Company (GTL)Policy Form MP-1400 and Rider Form Series GRG15CR and GRG15HAS issued to Affiliated Workers Association | ||||

| Benefit Description | Level 1 | Level 2 | Level 3 | Level 4 |

| Critical Illness Benefit (CI)* | ||||

| Benefit Eligibility | ||||

| Waiting Period | 60 Days | 60 Days | 60 Days | 60 Days |

| Pre-Existing Conditions Period | 12 Months | 12 Months | 12 Months | 12 Months |

| Benefit Eligibility for Pre-existing Conditions | 12 Months After Effective Date | |||

| Limited Specified Disease Benefit Rider | $2,500 | $5,000 | $7,500 | $10,000 |

| Heart Attack | 100% | 100% | 100% | 100% |

| Stroke | ||||

| Cancer Lump Sum Benefit Rider | $2,500 | $5,000 | $7,500 | $10,000 |

| Cancer Lump Sum Benefit | 100% | 100% | 100% | 100% |

* Pays a Lump Sum Benefit Amount as shown in the Schedule upon the first diagnosis of a Covered Condition.

Benefits under these riders terminate on the earliest date that the member turns age 65 or the date GTL has paid all benefits.

Guarantee Trust Life Insurance Company

| GROUP ACCIDENT ONLY INSURANCE PLANS Underwritten by Guarantee Trust Life Insurance Company Policy Form Series MP-1400 (or MP-1300) issued to Affiliated Workers Association |

||||

| Benefit Description | Level 1 | Level 2 | Level 3 | Level 4 |

| Stand-Alone Accidental Death & Dismemberment Benefit (AD&D)3 | ||||

| Principal Sum | $50,000 | $100,000 | $200,000 | $300,000 |

| Primary | 100% | 100% | 100% | 100% |

| Spouse | 50% | 50% | 50% | 50% |

| Child(ren) | 25% | 25% | 25% | 25% |

| Schedule of Benefits | ||||

| Loss of Life | 100% | 100% | 100% | 100% |

| Loss of Both Hands | ||||

| Loss of Both Feet | ||||

| Loss of the Entire Sight of Both Eyes | ||||

| Loss of One Hand and One Foot | ||||

| Loss of Speech and Hearing | ||||

| Loss of One Hand or One Foot and Entire Sight of One Eye | ||||

| Loss due to Hemiplegia | ||||

| Loss due to Paraplegia | ||||

| Loss due to Quadriplegia | ||||

| Loss of One Hand or One Foot | 50% | 50% | 50% | 50% |

| Loss of Entire Sight of One Eye | ||||

| Loss of Speech or Hearing | ||||

| Hearing in One Ear | 25% | 25% | 25% | 25% |

3 Accidental Death and Dismemberment Benefits are provided as shown in the Schedule of Benefits and pays the member or beneficiary up to the benefit amount listed for the member’s death or dismemberment due to a Covered Accident. Principal Sum will be reduced by 50% for Injury which occurs on or after a Covered Person’s 70th birthday.

Monthly Rates

| CI-AME-ADD | ||||

| Level 1 $2,500 | Level 2 $5,000 | Level 3 $7,500 | Level 4 $10,000 |

|

| Member | $63 | $86 | $109 | $131 |

| Member + Spouse | $86 | $141 | $194 | $242 |

| Member + Child(ren) | $68 | $101 | $134 | $164 |

| Member + Family | $104 | $164 | $227 | $282 |

| CI-ADD | ||||

| Level 1 $2,500 | Level 2 $5,000 | Level 3 $7,500 | Level 4 $10,000 |

|

| Member | $54 | $72 | $92 | $111 |

| Member + Spouse | $69 | $107 | $150 | $189 |

| Member + Child(ren) | $55 | $76 | $101 | $124 |

| Member + Family | $72 | $116 | $161 | $206 |

| AME-ADD | ||||

| Level 1 $2,500 | Level 2 $5,000 | Level 3 $7,500 | Level 4 $10,000 |

|

| Member | $44 | $52 | $60 | $65 |

| Member + Spouse | $53 | $65 | $79 | $87 |

| Member + Child(ren) | $49 | $59 | $69 | $76 |

| Member + Family | $61 | $79 | $98 | $110 |

| STAND-ALONE AD&D | ||||

| Level 1 $50,000 | Level 2 $100,000 | Level 3 $200,000 | Level 4 $300,000 |

|

| Member | $48 | $57 | $69 | $82 |

| Member + Spouse | $54 | $68 | $93 | $118 |

| Member + Child(ren) | $51 | $62 | $81 | $100 |

| Member + Family | $60 | $80 | $117 | $153 |

FAQ / Carrier Information

Carrier Information

Guarantee Trust Life

With 83 years of experience in the insurance industry, Guarantee Trust Life Insurance Company (GTL) has a proud heritage of providing excellent service and superior insurance products to individuals, families and groups across the country. Guarantee Trust Life Insurance Company is a mutual legal reserve company located in Glenview, IL and licensed to conduct business in 49 states and the District of Columbia and is rated “A-” (Excellent) by A.M. Best Company.

GTL believes in doing business the right way. They have a consistent track record of successfully delivering on their promises and preserving the trust that their partners, employees and policyholders place in them.

Their mission is to be recognized as a highly-competent, mid-sized mutual insurer, who by bridging timeless virtues with current best business practices, is effective in marketing targeted life and health products across the country.

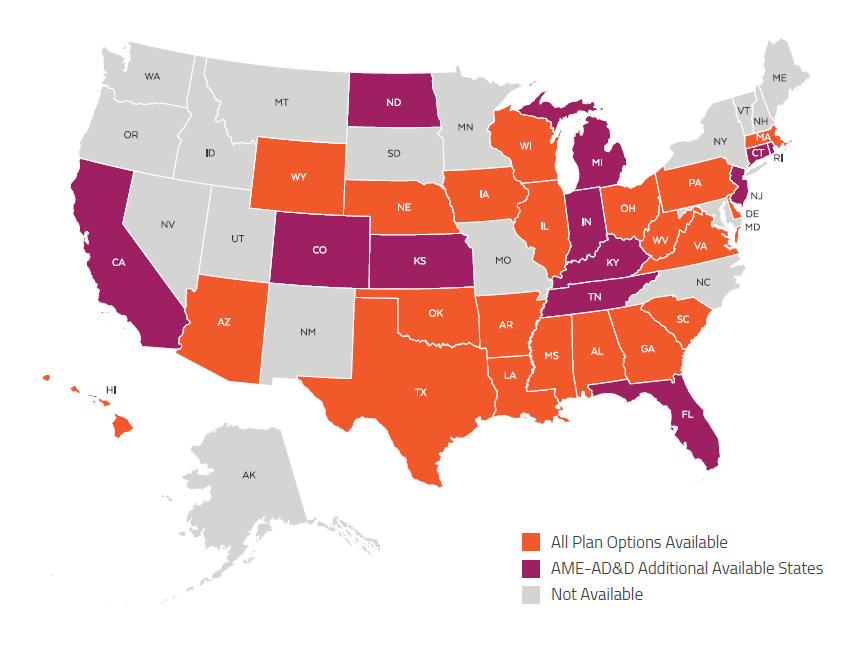

Membership Eligibility

Individuals may enroll in a SecureElite membership if they meet the following eligibility requirements:

- Between the ages of eighteen (18) and sixty-four (64)

- Reside in an available state

- Dependent children must be under age twenty-six (26)

AME-AD&D plan options are NOT Available in: AK, ID, ME, MD, MN, MO, MT, NV, NH, NM, NY, NC, OR, SD, UT, VT, WA.

Stand-Alone AD&D plan options are NOT Available in: AK, CO, ID, KS, LA, ME, MD, MN, MO, MT, NV, NH, NM, NY, NC, OR, RI, SD, UT, VT, WA.