About AWA Life Plus ADD

![]()

AWA Life Plus ADD provides members with access to Term Life and Accidental Death & Dismemberment insurance benefits, which can help in the event of an unexpected accident. Partnered with AirMed Emergency Medical Air Transport and FreeWill, members can better plan for the unexpected with AWA Life Plus ADD.

Click Each Tab Below to Learn More About AWA Life Plus ADD - Open All Tabs

Association Benefits

Consumer Discounts

Estate Planning Tool

Estate Planning Tool

Creating a will is simple and intuitive using an easy tool with questions about the member and their wishes. Members receive a PDF document that is theirs to download and print with instructions on how to make it official. And once an account is created, members can update and/or edit their will, or generate a new one at any time. FreeWill also includes tools to create an Advance Healthcare Directive, as well as a Durable Financial Power of Attorney.

Health Care Discounts

Emergency Medical Air Transport

Emergency Medical Air Transport

At home or abroad, the entire suite of AirMed medical transport benefits is available to AWA members* without deductibles, claim forms or out-of-pocket expenses.

If a medical emergency occurs while you are hours from home or halfway around the globe, members have seamless access to the highest level of acute care provided by the leading air medical company in North America – AirMed.

*Must be enrolled on an AWA membership that includes AirMed.

Insured Benefits

Group Term Life Insurance

Amalgamated Life Insurance Company

| Benefit | ||

| Level 1 | Level 2 | |

| Coverage | $10,000 | $15,000 |

| Eligibility | A Member will be eligible for Term Life Insurance if currently an active Member of the Affiliated Workers Association and: Has paid current dues to the Association; Member is actively at work; and Meets the eligibility conditions described in the Certificate. A Member is not eligible if the Member is not actively at work on the day you would normally become eligible. |

|

| Termination of Coverage | A Member's Term Life Insurance Benefit ends on the earliest of: The date the Policy terminates; The date the Member is no longer a member of the association; The last day of the month in which your employment in the eligible class under this policy ends; The date the Member is in active service in the armed forces of a country at war, declared or not; Any applicable premium is due and unpaid. |

|

| Age Reduction | Coverage reduces 35% of the original amount at age 65; 50% of the original amount at age 70. | |

| Accelerated Benefit | If a Member is terminally ill, the Member can receive up to 50% of their life coverage benefit in a lump sum as long as life expectancy is 12 months or less (as diagnosed by a physician). The Accelerated Benefit, less any administrative charge*, will be paid in a lump sum and any remaining Death Benefit under the Certificate will be reduced by the amount of Accelerated Benefit. The amount of any Accidental Death Benefit will not be affected by the payment of the Accelerated Benefit. Premium must continue to be paid for the Insured under the Group Policy after payment of an Accelerated Benefit in order to keep the remaining Certificate Death Benefit in force. Receipt of Accelerated Benefit may affect eligibility for public assistance programs and may be taxable. Please consult a personal tax advisor to determine the tax status of any benefits paid under this rider. *There is an administrative charge of $75 to process the Accelerated Benefit claim. |

|

Disclaimers

Information You Need to Know

Guaranteed Coverage – The maximum amount of coverage available during the initial enrollment period with no medical information required.

Coverage Effective Date – The date the membership in the Affiliated Workers Association becomes effective and all required dues have been paid.

Coverage Waiting Period – Coverage is subject to a 30 day waiting period. No benefit will be paid during the first 30 days of coverage.

Term Life Insurance is for the Primary Member Only. There is no term life coverage for Dependents. Child Only Coverage is Not Available.

Group Accidental Death & Dismemberment Insurance

Amalgamated Life Insurance Company

| Accidental Death & Dismemberment Insurance Underwritten by Amalgamated Life Insurance Company |

||

| Benefit Description | ||

| Accidental Death & Dismemberment Insurance Benefit | $100,000 | $150,000 |

| Maximum Benefit Amount | ||

| Named Insured (Primary Member) | 100% of Principal Sum Face Amount | |

| Schedule of Covered Losses | ||

| Loss of Life | 100% | |

| Loss of Both Hands or Both Feet | ||

| Loss of Sight of Both Eyes | ||

| Loss of Speech and Hearing | ||

| Quadriplegia | ||

| Loss of any two or more: One Hand, One Foot, Sight of One Eye, Speech, Hearing | ||

| Paraplegia | 75% | |

| Hemiplegia | 50% | |

| Loss of One Hand or One Foot | ||

| Loss of Sight of One Eye | ||

| Loss of Speech or Hearing | ||

| Uniplegia | 25% | |

| Additional Benefits | ||

| Airbag Benefit | Lesser of 10% of Insured's Principal Sum; or $10,000 | |

| Emergency Medical Evacuation Benefit | Lesser of actual cost of such services; or $10,000 | |

| Higher Education Benefit2 | Lesser of: the actual tuition (exclusive of room and board) charged by that institution for enrollment during that year for that Insured Dependent Child; or 2% of Insured’s Principal Sum on the date of the accident causing death; or $2,500. Maximum benefit period is 4 years per dependent child under age 25. Maximum total of $10,000 per child. | |

| Home Alteration and Vehicle Modification Benefit | Lesser of actual alteration expense; or 2% of Insured's Principal Sum; or $2,500 | |

| Rehabilitation Benefit1 | Lesser of: actual costs incurred for such rehabilitative physical therapy; or 10% of the Insured's Principal Sum; or $10,000 | |

| Repatriation of Remains Benefit | Lesser of the actual cost of such transportation; or $5,000 if the Insured dies as a result of a covered injury sustained outside the US. | |

| Seatbelt Benefit | Lesser of 10% of Insured's Principal Sum; or $50,000 | |

1 Not available in MD

2 Not available in NJ

Monthly Rates

| Life Plus ADD Monthly Membership Rate | |

|---|---|

| $10,000 Life + $100,000 AD&D | $15,000 Life + $150,000 AD&D |

| $79 | $89 |

Membership Eligibility

Individuals may enroll in a Life Plus ADD membership if they meet the following eligibility requirements:

- Between the ages of eighteen (18) and sixty-four (64)

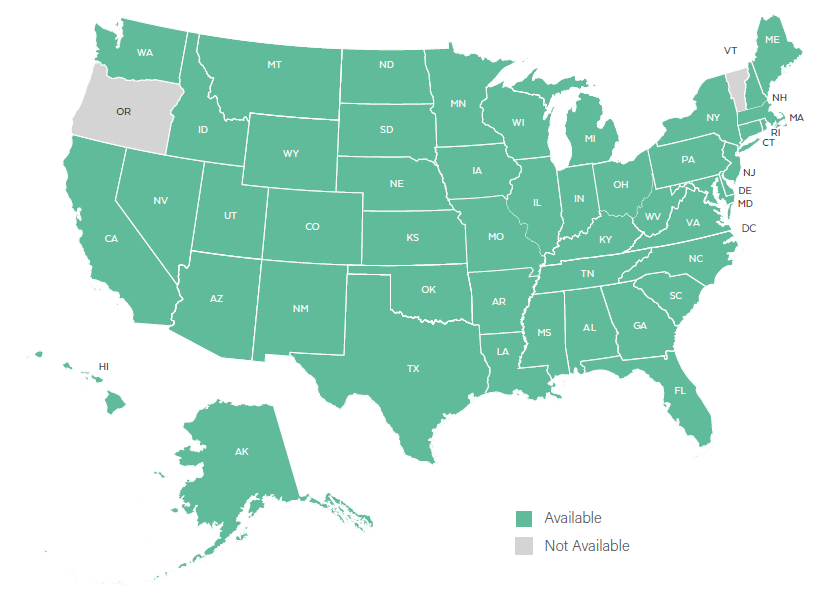

- Reside in an available state

- Legal Resident of the United States

- Small Business Owner, Self-Employed Professional, Contractor or Entrepreneur

- Must remain a member of the Affiliated Workers Association