About Private: ThriveHealth STM

Length of Coverage

Available for up to 36 months of coverage depending upon state regulations.

Coverage Effective Date

Next day coverage; later effective date available, but not to exceed 60 days from date of transmission

Waiting Period

- 5 days for sickness

- 30 days for cancer

- No waiting period for injuries

The ThriveHealth STM program is a good option for:

- For those who are between jobs or have been laid off

- For those who are waiting for employer benefits

- For those who have part-time or temporary employment

- For those who have recently graduated

- For those who are without adequate health insurance

How will consecutive policy terms work?

When a member applies for consecutive policy terms in one enrollment, they will be issued their initial term of coverage, and subsequent terms will be pending. The waiting period on all subsequent terms will be waived. Members will not have to reapply for additional terms. When subsequent terms of coverage are set to begin, the customer will receive an email stating their plan has started a new term. The email will provide them with their new monthly rate (if applicable), and they will have the opportunity to opt out at this time.

Will the plan benefits carry-over between terms?

Deductible and coinsurance and all benefit limits will reset with each 12 month period of coverage.

Click Each Tab Below to Learn More About Private: ThriveHealth STM - Open All Tabs

Association Benefits

Consumer Discounts

NCE Association membership is included with ThriveHealth STM

NCE Association membership is included with ThriveHealth STM

National Congress of Employers (NCE) is a national association formed in 1996 that supports the needs of micro-businesses. NCE members enjoy exclusive access to a number of discounts on products and services from key service providers. We continuously work with companies to ensure members are getting the best offers. NCE members regularly enjoy discounts for Health, Fitness and Diet products and services. Members can also access the association group insured products.

Value Added Benefits

PHCS PPO Network

The PHCS Network is a Preferred Provider Organization (PPO). A PPO is a network of health care providers who agree to provide services at a pre-negotiated rate. The PHCS Network is an important feature of your Health Depot Plan. You have access to thousands of hospitals, practitioners and ancillary facilities who have agreed to significant discounts on their medical services. The PHCS Network includes nearly 4,400 hospitals, 79,000 ancillary care facilities and more than 700,000 healthcare professionals nationwide.

With discounts averaging 42% for physicians and specialists—the types of services most typically used with these plans—Health Depot members get more value for their benefit dollars.

NCE GapAfford Plus

National Congress of Employers (NCE) is a national association formed in 1996 that supports the needs of micro-businesses. NCE members enjoy exclusive access to a number of discounts on products and services from key service providers. We continuously work with companies to ensure members are getting the best offers. NCE members regularly enjoy discounts for Health, Fitness and Diet products and services. Members can also access the association group insured products.

Short Term Medical Benefits

ASFLIC and Standard Life and Casualty Insurance Company

| Lite | Traditional | ||

| PPO Network | PHCS Practitioner & Ancillary Network | ||

| Deductible Options | $500, $1,000, $2,000, $2,500, $5,000, $7,500, $10,000 | ||

| Coinsurance | 80/20 | ||

| Coinsurance Limit | $2,000 | ||

| Coverage Period Maximum Benefit Options | $250,000, $500,000, $1,000,000 | ||

| Doctor Office Visits* | |||

| Copay - Primary Care Physician or Urgent Care Facility Visit | Option 1 | $25 per Visit, 2 Visits per Covered Person per Coverage Period | $15 per Visit, Unlimited Visits per Covered Person per Coverage Period |

| Option 2 | $25 per Visit, Unlimited Visits per Covered Person per Coverage Period |

||

| Copay - Specialist Physician Visit | Option 1 | $40 per Visit, 2 Visits per Covered Person per Coverage Period | $25 per Visit, Unlimited Visits per Covered Person per Coverage Period |

| Option 2 | $40 per Visit, Unlimited Visits per Covered Person per Coverage Period |

||

| Urgent Care Facility Additional Deductible | None | $100 | |

| Copay - Wellness Visit | $50 per Visit, Maximum 1 Visit per Covered Person per Coverage Period. Not subject to Deductible and Coinsurance. |

||

| Inpatient Hospital Covered Expenses | |||

| In Hospital Regular Care | Subject to Deductible and Coinsurance. The Average Semi-Private Room Rate up to $1,500 per day including all Inpatient miscellaneous medical expenses except for professional fees. | Subject to Deductible and Coinsurance | |

| In Hospital Intensive or Critical Care | Subject to Deductible and Coinsurance, up to $2,000 per day including all Inpatient miscellaneous medical expenses except for professional fees. | Subject to Deductible and Coinsurance | |

| In Hospital Physician Visits | Subject to Deductible and Coinsurance, up to $50 per day up to a maximum $500 per Coverage Period. | Subject to Deductible and Coinsurance | |

| Surgical Covered Expenses | |||

| Outpatient Hospital Surgery or Ambulatory Surgical Center | Subject to Deductible and Coinsurance, up to $1,500 per day including all miscellaneous medical expenses except for professional fees. | Subject to Deductible and Coinsurance | |

| Surgical Services | Subject to Deductible and Coinsurance, up to $5,000 per Surgery for all surgical services combined, and up to $10,000 per Coverage Period. | Subject to Deductible and Coinsurance | |

| Assistant Surgeon | Subject to Deductible and Coinsurance, up to $1,000 per Surgery for all Assistant Surgeon services combined, and up to $2,000 per Coverage Period. | Subject to Deductible and Coinsurance | |

| Anesthesia | Subject to Deductible and Coinsurance, up to $1,000 per Surgery for all anesthesia services combined, and up to $2,000 per Coverage Period. | Subject to Deductible and Coinsurance | |

| Miscellaneous Medical Covered Expenses | |||

| Emergency Room Treatment | Subject to the Emergency Room Additional Deductible shown below, then Deductible and Coinsurance. The Additional Deductible is waived if admitted within 24 hours of Emergency Room Treatment. Up to $250 per visit including the Emergency Room Physician charge, observation and all miscellaneous medical expenses received during the ER visit. | Subject to the Emergency Room Additional Deductible shown below, then Deductible and Coinsurance. The Additional Deductible is waived if admitted within 24 hours of Emergency Room Treatment. | |

| Emergency Room Additional Deductible | None | $250 | |

| Ambulance, Ground or Air | Subject to Deductible and Coinsurance, up to $500 per trip for Ground Ambulance, up to $1,000 per trip for Air Ambulance. |

||

| Outpatient Miscellaneous Hospital Expenses | Subject to Deductible and Coinsurance, up to $1,500 excluding Outpatient surgery per Coverage Period. | Subject to Deductible and Coinsurance | |

| Other Outpatient Miscellaneous Medical Services | Subject to Deductible and Coinsurance | ||

| Therapy Services - Physical Therapist, Speech Therapist and Occupational Therapist | Subject to Deductible and Coinsurance, up to $30 per day and a maximum of 15 days per Coverage Period. | ||

| Durable Medical Equipment and Medical Supplies | Subject to Deductible and Coinsurance | ||

| Bone Density Testing | Subject to Deductible and Coinsurance, up to $150 per Coverage Period | ||

| Home Health Care | Subject to Deductible and Coinsurance, up to $30 per day and a maximum of 30 days per Coverage Period. | ||

| Other Covered Expenses | |||

| Organ, Tissue, Bone Marrow Transplants | Subject to Deductible and Coinsurance, up to $50,000 per Coverage Period for all Covered Expenses including Inpatient Hospital, Surgical and Outpatient Miscellaneous Medical Covered Expenses. | Subject to Deductible and Coinsurance, up to $100,000 per Coverage Period for all Covered Expenses including Inpatient Hospital, Surgical and Outpatient Miscellaneous Medical Covered Expenses. | |

| Skilled Nursing Facility | Subject to Deductible and Coinsurance, up to $100 per day and 30 days per Coverage Period. | ||

| Hospice Care | Subject to Deductible and Coinsurance, up to $5,000 per Coverage Period. | ||

| Acquired Immune Deficiency Syndrome (AIDS) | Subject to Deductible and Coinsurance, up to $10,000 per Coverage Period for all Covered Expenses including Inpatient Hospital, Surgical and Outpatient Miscellaneous Medical Covered Expenses. | ||

| Joint/Tendon Surgery | Subject to Deductible and Coinsurance, up to $3,000 per Coverage Period for all Covered Expenses including Inpatient Hospital, Surgical and Outpatient Miscellaneous Medical Covered Expenses. | ||

| Knee Injury or Disorder for both left and right knees | |||

| Gallbladder Surgery | |||

| Appendectomy | |||

| Kidney Stones | |||

| Temporomandibular Joint Disorder (TMJ) | |||

Disclaimers

* Physician Office Visits and Urgent Care Facility visits in excess of the number of Visits covered by the Copayments are subject to Deductible and Coinsurance. Urgent Care Facility Visits are also subject to the Urgent Care Facility Additional Deductible shown above. Additional services performed during a Physician Office Visit or an Urgent Care Facility Visit will be subject to Deductible and Coinsurance.

Disclaimer: Unless specified otherwise, the benefits listed above are subject to the plan Deductible, Coinsurance Percentage, Out-Of-Pocket

Maximum and Policy Maximum chosen for the Insured and each Covered Dependent . All benefits are limited to Usual, Reasonable and

Customary Amounts. Usual, Reasonable and Customary Amounts. Definition may vary by state. Coverage is not limited to the benefits listed;

any eligible expenses are subject to plan limitations. Please check the product certificate or master policy for complete details.

FAQ / Carrier Information

About the Carrier

American Financial Security Life Insurance Company

American Financial Security Life Insurance Company (“AFSLIC”) was organized in 1957 and has been under current ownership since 2008. AFSLIC provides a broad range of insurance services such as Short Term Medical, Fixed Indemnity, Accident, and Critical Illness Insurance products for individuals and groups in over 25 States.

With corporate headquarters located in southern Florida, a regional office in New York City, and a nationwide network of distributors and agents, AFSLIC is able to meet and better serve the needs of members throughout the country.

Through their plans, members receive health benefits customized to their insurance needs, becoming better equipped to meet the financial demands of ever-rising healthcare costs.

Standard Life and Accident Insurance Company

Standard Life and Accident Insurance Company (“Standard Life”), American National Life Insurance Company of Texas (ANTEX), and Garden State Life Insurance Company are subsidiaries of American National Insurance Company. The company was founded in 1976 and is headquartered in Texas. Each issuing company has financial responsibility only for the products and

services it issues.

Standard Life offers a variety of supplemental insurance products including Accident, Critical Illness, Hospital Indemnity, Limited Medical, and Short Term Medical for individuals and companies.

As of November 2019, Standard Life has received an industry rating of A (Excellent) by A.M. Best Company, and A- (Excellent) by Standard & Poor’s. Both rating companies provide independent analytical information to the marketplace.

Enrollment Tips

The ThriveHealth STM plans includes Discount Dental and Vision benefits.

- Therefore, if members enroll in the STM plan, they wouldn’t want/need to enroll in the Renew Dental Vision program, because they will already have those benefits.

- However, you may want to enroll in the Ideal Dental plan, because that is an insured dental plan and offers more comprehensive coverage for oral care than simple discounts.

How to Enroll

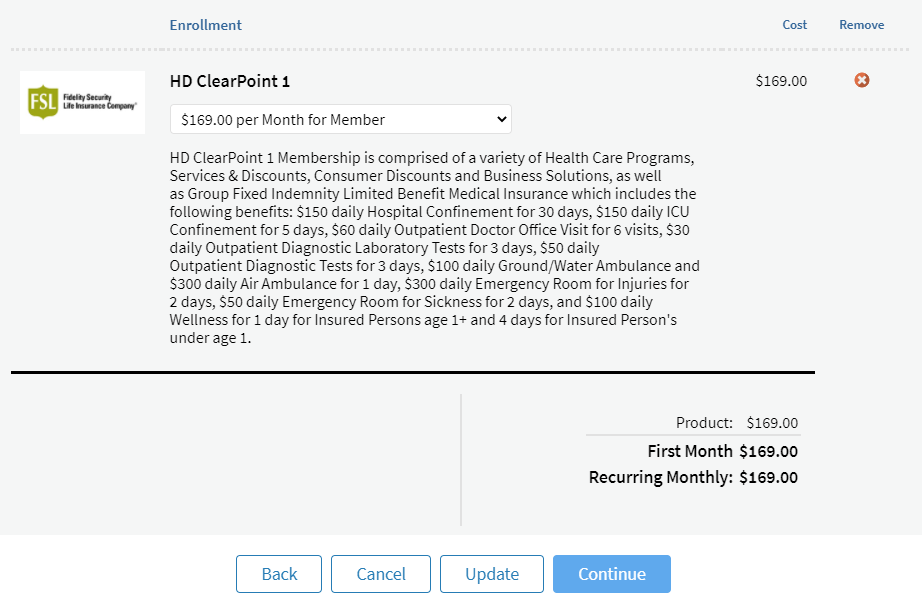

Coverage Selection

- Visit www.1enrollment.com/hpma to set up your account.

- Click Enroll on your first selection

- Select coverage level on dropdown

- Scroll down to bottom of page for additional selections

- Verify coverage level is correct for each product

- Click Continue

Check Out

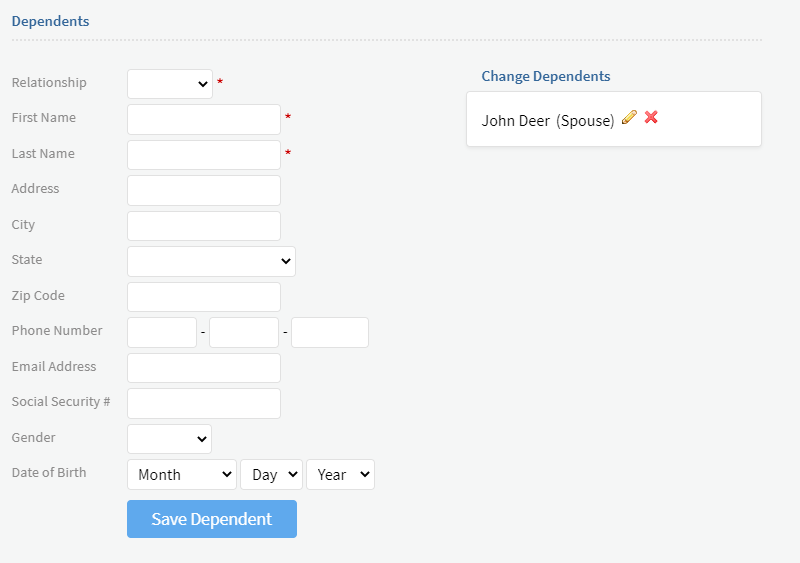

- Complete required information denoted by red asterisk

- Review effective date(s) for each product

- Fill out and click Save Dependent for each dependent

- Completed dependents will show up on the right side of the screen

- Review and Check the Authorization Section

Verification

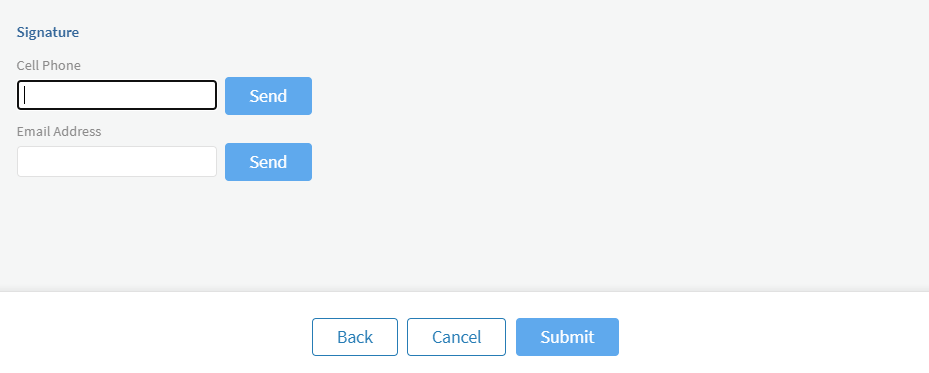

- Click Send Link under Signature and fill in Cell Phone or Email

- Review, Approve and Sign Your Document message will be sent to Cell Phone or Email

- Review your enrollment information, check any applicable boxes, sign, type your name and click Accept

- Go back to enrollment site and wait until you see Signature Document Received in a green box

- Click Submit and you will see a Confirmation screen

Immediately upon enrollment, you will receive a Welcome Email for each product you selected with details on your membership.

For any questions during the Enrollment process, please contact Member Services at (214) 436-8869.

Ready to Get Started?

Proceed to enrollment site to fill out your health application and verify your membership plan. If you prefer to speak with a representative, fill out form below and a licensed agent will be in touch.