About HD Select Access

The HD Select Access membership provides members with access to a variety of health care programs, services and discounts to help you manage your everyday healthcare expenses, as well as consumer and lifestyle discounts and business solutions.

The HD Select Access membership also provides each Member coverage under Accident and Sickness Limited Benefit, Accident Medical Expense and Accidental Death & Dismemberment Insurance. HD Select Access Insurance benefits can help with out-of-pocket medical expenses as well as living expenses. And, these memberships are offered year round versus short enrollment periods. Whatever your circumstance, an HD Select Access membership may be the answer you are looking for.

Click Each Tab Below to Learn More About HD Select Access - Open All Tabs

Association Benefits

Consumer Discounts

Car Rental Discounts

Car Rental Discounts

Take advantage of affordable auto rental rates from Avis®, Budget® and Dollar® Rent A Car.

Moving Discounts

Moving Discounts

Cord Moving and Storage Co., an agent for North American Van Lines, offers members valuable discounts on moving and relocation services while providing the highest level of service and customer satisfaction.

GlobalFit Gym Network

GlobalFit Gym Network

Members receive discounted gym memberships at more than 9,000 gyms nationwide including, L.A. Fitness, Anytime Fitness, Gold’s Gym, 24 Hour Fitness, and local favorites. Members can also take advantage of exclusive member savings on wearable technology, diet resources like Jenny Craig and Nutrisystem, meal plans and diet delivery options, and vitamins and supplements.

Gym America

Gym America

Online access for personalized meal plans tailored to your needs, interactive tools for keeping you on track with fitness and nutrition goals, smart weekly shopping lists and much more for a special price.

Massage Envy

Massage Envy

A spa day isn’t just a way to pamper yourself—a massage can also offer health benefits to many people. Whether you suffer from chronic pain such as headaches and back issues or have a highstress life, a massage may help. Members receive up to 20% off many of the plans and services at Massage Envy.

True Car Auto Buying Service

True Car Auto Buying Service

Save time and money shopping for a new or used car through True Car. Members receive exclusive pricing, price protection and a hassle-free buying experience at thousands of Certified Dealers.

My Association Savings

My Association Savings

My Association Savings Benefits from Abenity provides members with exclusive perks and over $4,500 in savings on everything from pizza and the zoo, to movie tickets, oil changes, hotels, and car rentals! And, with over 102,000 available discounts across 10,000 cities in the United States and Canada, you’ll never be far from savings!

Popular Features Include:

• Nearby Offers: Use our show & save mobile coupons to quickly access savings on the go.

• eTickets On Demand: Save up to 40% with no hidden fees.

• Show times: Find movies, watch trailers, and save up to 40% at a theater near you.

• Monthly Giveaways: Win cash, movie tickets, electronics and more with our monthly contests.

Financial Counseling

Financial Counseling

Through My Secure Advantage (MSA), HD members and eligible family members have all the resources needed to feel confident about financial goals in any stage of life – be it growing a family, buying a house, caring for aging parents, or planning retirement.

CLC ID Theft & Fraud Resolution

CLC ID Theft & Fraud Resolution

Members and family receive identity theft and fraud resolution services through CLC, Inc. The CLC identity theft resolution program was developed to help guide victims of identity theft and other fraudulent crimes through the complex process of restoring their personal identity, credit rating, financial security, and legal integrity. This benefit includes ID Monitoring, Fraud Restoration, Document Preparation, Lost/Stolen Purse or Wallet Services, Financial Coaching, and Legal Consultation.

CLC Legal Access

CLC Legal Access

Through the CLC Legal Access program, our members have access to free initial legal consultations and discounted services to address many common legal concerns. Members also receive simple will preparation and access to online legal resources at no additional cost.

Health Care Discounts

Telehealth

Telehealth

Talk to a doctor by phone, web or mobile app anytime, anywhere. From your home, office, hotel room, or vacation campsite, simply make a phone call, and in most cases, speak to a doctor in less than 30 minutes, with an average call back time of less than 10 minutes. When you call Teladoc, you will always speak to a doctor who lives and works in the United States and is licensed to practice medicine in your state. Teladoc is also the only telemedicine provider able to treat children from 0-17¹ . It’s health care that fits in the palm of your hand.

ScriptSave Rx Savings Card

ScriptSave Rx Savings Card

The ScriptSave Prescription Savings Card provides you access to discounted prescription drug prices. All household members can use the same card – including pets, if the pet medication is a common drug that is also used by people. There are no limits on how many times members and their family can use the card.

IDLife Nutritional Products

IDLife Nutritional Products

IDLife products are scientifically formulated to help you by providing therapeutic doses of specific nutrients to:

- Restore nutrients depleted by your Rx program

- Help your body resist Rx side effects

- Improve your overall nutrition status thus optimizing your health

Additionally, they have been pre-screened to avoid drug/nutrient interactions that may be present with your current vitamin program.

Laboratory Testing

Laboratory Testing

MyMedLab offers an efficient, affordable and confidential solution to medical laboratory testing. You can purchase the same testing ordered by your doctor at a cost 50% to 80% less than in your doctor’s office or local hospital lab.

Testing can be purchased 24 hours a day on the MyMedLab website. Tests are listed both individually and in groups called Wellness Profiles based on your age, sex and family history. This basic information is all you need to identify which profile evaluates your risk for common conditions associated with your specific group.

Hearing Products and Screenings

Hearing Products and Screenings

Members and their immediate family members (grandparents, parents, spouse and children) will receive complimentary hearing screenings and a 15% retail discount off the usual and customary retail price of any Beltone hearing instrument at any of over 1500 locations throughout the United States.

Small Business Discounts

ADP Payroll Processing

ADP Payroll Processing

Members can access a 25% discount on processing costs and a free month of payroll processing. In addition, the one-time setup fee will be waived.

Computer and Technology Products

Computer and Technology Products

Hewlett-Packard offers members affordable pricing on business and home office products. Members receive discounts on HP notebooks, laptops, desktops, servers, printers, digital cameras, handhelds, point-of-sale (scanners, cash registers, etc.) and more.

NAC Web Services

NAC Web Services

Members can access discounts on website development and maintenance as well as web hosting. Their experienced staff of programmers and graphic designers offer creative and intuitive websites custom-built to your specifications.

Office Depot Office Supplies

Office Depot Office Supplies

Members save 15% off hundreds of office supplies and 60% off printing online, by phone/fax, or in stores. Members also receive additional monthly special offers and incentives, as well as free next day delivery on qualifying orders of $50 or more (reduced shipping costs for lesser orders).

Penny Wise Office Supplies

Penny Wise Office Supplies

Members receive the guaranteed lowest prices on over 20,000 office products and additional savings when orders are placed online. Fast, free shipping is also virtually guaranteed from the 40 Penny Wise distribution centers nationwide.

Sprint/T-Mobile

Sprint/T-Mobile

Sprint/T-Mobile Wireless Services

Get more savings and more value as you add more lines to your small business Sprint account. In addition to member discounts on devices and monthly plans, leverage Sprint’s easy team management solutions, priority support, and mobile security features. Members receive up to $650 in credits for each line you switch to Sprint’s network, as well as access to business features like in-vehicle wifi, push-to-talk connectivity and fleet management solutions.

UPS Shipping

UPS Shipping

Members receive discounts on UPS delivery services for a variety of next day, 2-day and 3-day shipping options.

Value-Added Benefits

MultiPlan PPO Network

The MultiPlan Limited Benefit Plan Network is a Preferred Provider Organization (PPO). A PPO is a network of health care providers who agree to provide services at a pre-negotiated rate. The MultiPlan Network is an important feature of your Health Depot membership. You have access to thousands of hospitals, practitioners and ancillary facilities who have agreed to significant discounts on their medical services. The MultiPlan Network includes nearly 4,400 hospitals, 79,000 ancillary care facilities and more than 700,000 healthcare professionals nationwide.

With discounts averaging 42% for physicians and specialists—the types of services most typically used with these plans—Health Depot members get more value for their benefit dollars.

Karis360

Karis360’s team of Advisors offer personalized, caring, expert service helping members navigate the complex and expensive healthcare maze. With services from Healthcare Navigator to Bill Negotiator to Surgery Saver to Chaplaincy, Karis360 will sort through your healthcare needs saving you time and money.

Karis360 sorts through healthcare paperwork

Karis360 saves time and money

Karis360 provides unlimited assistance from a Personal Advisor

View real member testimonials for:

Bill Negotiation Health Care Navigator

Insured Benefits

Accident and Sickness Limited Benefit Insurance

| Benefit Description | Select Access Level 3 |

| In-Hospital Indemnity Benefit | |

| Pays a daily benefit for each day a Covered Person is Confined to a Hospital due to an Accident or Sickness. The first day of Confinement in the Hospital must occur within thirty (30) days of the Accident causing the injury. | |

| Daily Benefit Amount | $700 |

| Maximum Number of Days per Period of Confinement | 10 |

| Maximum Benefit Amount per Sickness and Accident Combined per Plan Year | $21,000 |

| Intensive Care Unit Indemnity Benefit | |

| Pays a daily benefit for each day of Confinement if an Accident or Sickness causes a Covered Person to be Confined to an Intensive Care Unit (ICU). The first day of Confinement in the Intensive Care Unit must occur within thirty (30) days of the Accident. This benefit is paid in addition to the In-Hospital Indemnity Benefit Amount. | |

| Daily Benefit Amount | $1,500 |

| Maximum Number of Days per Period of Confinement | 30 |

| Maximum Benefit Amount per Sickness and Accident Combined per Plan Year | $50,000 |

| In-Hospital Surgical Indemnity Benefit | |

| Pays the Surgical Indemnity Benefit if a Covered Person has a Major or Minor Surgical Procedure (depending on the plan level elected) performed while In-Hospital. A surgical procedure due to Accident must occur within thirty (30) days of the Accident causing an Injury. | |

| Benefit Amount per Major Procedure per Covered Person per Plan Year | $750 |

| Benefit Amount per Minor Procedure per Covered Person per Plan Year | $750 |

| Maximum Number of Procedures per Covered Person per Plan Year | 1 |

| Emergency Room Indemnity Benefit | |

| Benefit pays if an Accident or Sickness causes the Covered Person to require and receive Emergency Medical Care in an Emergency Room of a Hospital. Treatment must be received within twenty-four (24) hours of the Accident. | |

| Per Visit Benefit Amount | $100 |

| Maximum Number of ER Visits per Plan Year | 1 |

| Ground Ambulance Transportation Indemnity Benefit | |

| Benefit pays if a Covered Person requires the use of an ambulance service by ground for transportation to or from a Hospital or from one Hospital to another Hospital for care and treatment of a covered Accident or Sickness. | |

| Per Trip Benefit Amount | $200 |

| Maximum Number of Trips per Plan Year | 1 |

| Air Ambulance Transportation Indemnity Benefit | |

| Benefit pays if a Covered Person requires the use of an ambulance service by air for transportation to or from a Hospital or from one Hospital to another Hospital for care and treatment of a covered Accident or Sickness. | |

| Per Trip Benefit Amount | $500 |

| Maximum Number of Trips per Plan Year | 1 |

| Physician Office Visit Indemnity Benefit | |

| Benefit pays for a Covered Person’s Physician Office or Clinic Visit due to an Accident or Sickness. The visit must occur within thirty (30) days of the Accident causing an injury. This benefit is not payable for routine eye exams, dental exams (unless the result of an accident), or annual physical exams. | |

| Per Visit Benefit Amount | $75 |

| Maximum Number of Visits per Plan Year | 5 |

| Outpatient Surgical Indemnity Benefit | |

| Pays the Surgical Indemnity Benefit if a Covered Person has a Major or Minor Surgical Procedure (depending on the plan level elected) performed on an outpatient basis in an Outpatient Unit. A surgical procedure due to Accident must occur within thirty (30) days of the Accident causing an Injury. | |

| Benefit Amount per Major Procedure per Covered Person per Plan Year | $750 |

| Benefit Amount per Minor Procedure per Covered Person per Plan Year | $750 |

| Maximum Number of Procedures per Covered Person per Plan Year | 1 |

| Outpatient Diagnostic X-Ray and Laboratory Indemnity Benefit | |

| Benefit pays if a Covered Person has diagnostic x-ray and laboratory tests related to an Accident or Sickness. The tests must be ordered by a Physician and performed on an outpatient basis. Preventive tests are payable under the Wellness Indemnity Benefit and not payable under this Benefit. Tests performed due to an Accident must be done within thirty (30) of the Accident causing Injury. | |

| Benefit Amount per X-ray or Lab Test | $200 |

| Maximum Number of X-rays and Lab Tests per Plan Year | 1 |

| Advanced Diagnostic Test Indemnity Benefit | |

| Benefit pays if a Covered Person has one of the following tests performed on an outpatient basis: Angiogram /Arteriogram, EEG, Myelogram, CT Scan, MRI Scan, or PET Scan. The tests must be ordered by a Physician and be related to an Accident or Sickness. This benefit does not pay for tests performed while Confined in a Hospital. | |

| Benefit Amount per Test | $200 |

| Maximum Number of Tests per Covered Person per Plan Year | 1 |

| Wellness Indemnity Benefit1 | |

| Benefit pays if an Insured Person or his/her Spouse or Domestic Partner has one of the following screening tests: Stress test on a bicycle or treadmill; Fasting blood glucose test; Blood test for triglycerides; Serum cholesterol test to determine level of HDL and LDL; Bone marrow testing; Breast ultrasound; CA 15-3 (cancer antigen 15-3 - blood test for breast cancer); CA125 (cancer antigen 125 - blood test for ovarian cancer); CEA (carcinoembryonic antigen - blood test for colon cancer); Chest X-ray; Colonoscopy; Flexible sigmoidoscopy; Hemoccult stool analysis; Mammography; Pap smear; PSA (blood test for prostate cancer); Serum Protein Electrophoresis (blood test for myeloma); Thermography; ThinPrep Pap Test; Virtual Colonoscopy. This benefit is payable once per Plan Year per Insured Person or the Insured Person’s covered Spouse or Domestic Partner. If the benefit is payable under the Diagnostic X-Ray and Laboratory Indemnity Benefit or the Surgical Indemnity Benefits as it relates to an Accident or Sickness, it will be paid under that benefit and not this Wellness Indemnity Benefit. | |

| Benefit Amount per Preventive Screening Test | $100 |

| Maximum Number of Tests per Plan Year | 1 |

| Accident Medical Expense Benefit2 | |

| Reimburses up to $2,000 less the deductible if Accidental Bodily Injury causes an Insured Person to first incur Medical Expenses for care and treatment of the Accidental Bodily Injury within ninety (90) days after an Accident. The Benefit Amount is payable only for Medical Expenses incurred within 52 weeks after the date of the Accident causing the Accidental Bodily Injury. | |

| Maximum Benefit per Covered Accident | $2,000 |

| Deductible per Covered Accident | $200 |

| Accidental Death Benefit (Principal Sum)3 | |

| Pays a lump sum if an Accident results in a covered Loss listed below, such as loss of life, limb, speech, sight or hearing. If more than one loss is sustained as the result of one Accident, the single largest benefit will pay. The covered Loss must occur within one (1) year after the Accident. | |

| Loss of Life | $10,000 |

| Loss of Speech and Hearing (Both Ears) | $10,000 |

| Loss of Speech and One Hand, One Foot or Sight of One Eye | $10,000 |

| Loss of Hearing and One Hand, One Foot or Sight of One Eye | $10,000 |

| Loss of Both Hands or Feet | $10,000 |

| Loss of Sight or a combination of any two Hand, Foot or Sight of One Eye | $10,000 |

| Loss of Hand or Foot | $5,000 |

| Loss of Sight of One Eye | $5,000 |

| Loss of Speech or Hearing (Both Ears) | $5,000 |

| Loss of Thumb and Index Finger of the Same Hand | $2,500 |

Disclaimers

1 Wellness Indemnity Benefit does not cover Dependent Children. Wellness Indemnity Benefit is not available in CA and OH.

2 The Accident Medical Expense Benefit is payable on a primary basis for residents of FL, IN & OH. In all other jurisdictions, the Accident Medical Expense Benefit is payable on an excess basis. This means that the insurer will determine the Reasonable and Customary Charge for the covered Medical Expense and will then reduce that amount by amounts already paid or payable by any Other Plan, less the deductible. In no event will the Insured receive more than the Maximum Benefit Amount.

3 The Primary Member’s benefit is equal to 100% of the Principal Sum listed. The Spouse’s or Domestic Partner’s benefit is equal to 50% of the Member’s Principal Sum. Dependent Children’s benefit is equal to 10% of the Member’s Principal Sum.

Important Notice: This information is a brief description of the important features of this insurance plan. It is not an insurance contract. Insurance benefits are underwritten by Federal Insurance Company, a member insurer of the Chubb Group of Companies. Coverage may not be available in all states or certain terms may be different where required by state law. Chubb NA is the U.S.-based operating division of the Chubb Group of Companies, headed by Chubb Ltd. (NYSE:CB) Insurance products and services are provided by Chubb Insurance underwriting companies and not by the parent company itself.

Monthly Rates

| Level 3 | |

| Member | $269 |

| Member + 1 | $385 |

| Member + Family | $455 |

FAQ / About the Carrier

About the Carrier

Underwritten by Federal Insurance Company

Chubb is the world’s largest publicly traded property and casualty insurer. With operations in 54 countries, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. Insurance products and services are provided by Chubb Insurance underwriting companies and not by the parent company itself.

Federal Insurance Company has a 2017 AM Best rating of A++ (Superior). This rating is an indication of the company’s financial strength and ability to meet obligations to its insureds.

Chubb Limited, the parent company of Chubb, is listed on the New York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index.

Chubb maintains executive offices in Zurich, New York, London and other locations, and employs approximately 31,000 people worldwide.

Membership Eligibility

- Between the ages of eighteen (18) and sixty-four (64)

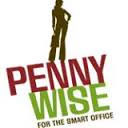

- Be a U.S. citizen residing in an available state

- Dependent children must be under the age of nineteen (19) or under the age of twenty-five (25) if enrolled as a full-time student at an Institution of Higher Learning

Health Care Discounts Disclosure

Not Available in AK, OK, UT, VT, WA. If members move to one of those states, their discount medical benefits will terminate.

The discount medical, health and drug benefits (The Plan) are NOT insurance, a health insurance policy, a Medicare Prescription Drug Plan or a qualified health plan under the Affordable Care Act.

The Plan provides discounts for certain medical services, pharmaceutical supplies, prescription drugs or medical equipment and supplies offered by providers who have agreed to participate in the Plan. The range of discounts for medical, pharmacy or ancillary services offered under The Plan will vary depending on the type of provider and products or services received. The Plan does not make and is prohibited from making members’ payments to providers for products or services received under The Plan. The Plan member is required and obligated to pay for all discounted prescription drugs, medical and pharmaceutical supplies, services and equipment received under The Plan, but will receive a discount on certain identified medical, pharmaceutical supplies, prescription drugs, medical equipment and supplies from providers in The Plan. The Discount Medical Plan Organization/Discount Plan Organization is Alliance HealthCard of Florida, Inc., 5005 LBJ Freeway, Suite 1500, Dallas, Texas 75244. You may call 214-436-8882 or email customerservice@premierhsllc.com for more information or visit myhealthaccountmanager.com for a list of providers. The Plan will make available before purchase and upon request, a list of program providers and the providers’ city, state and specialty, located in the member’s service area. Alliance HealthCard of Florida, Inc. does not guarantee the quality of the services or products offered by individual providers. You have the right to cancel your membership at any time. If you cancel your membership within 30 days of the effective date, you will receive a full refund of all periodic charges. The processing fee is non-refundable except in AR, MD and TN. To cancel you must, notify the Health Depot Association verbally or in writing; notify Health Depot Association at 2601 Network Blvd, Suite 500, Frisco, TX 75034 or by calling 214-436-8882. We will stop collecting membership fees in a reasonable amount of time, but no later than 30 days after cancellation. Any complaints should be directed to Alliance HealthCard of Florida, Inc. at the address or phone number above. Upon receipt of the complaint, member will receive confirmation of receipt within 5 business days. After investigation of the complaint, Alliance HealthCard of Florida, Inc. will provide member with the results and a proposed resolution no later than 30 days after receipt of the complaint.

Note to DE, IL, LA, NE, NH, OH, RI, SD, TX, and WV consumers: If you remain dissatisfied after completing the complaint system, you may contact your state department of insurance.

Note to MA consumers: The plan is not insurance coverage and does not meet the minimum creditable coverage requirements under M.G.L. c. 111M and 956 CMR 5.00.